Frenzy without end – how many pounds did the Greeks sold and bought

In a nonstop upward move, gold has been engaged, recording continuous new historically high, Greek investors remain fixed gold pounds.

Gold exceeded the $ 3,200 threshold, as the dollar drop and the scaling US-China trade caused fears of recession, leading investors to seek the security of the yellow metal.

In its report, Commerzbank on precious metal reports that in the last ten days there have been intense fluctuations and gold prices with them even receiving $ 100 from record levels. It is not uncommon for gold to initially pressure in times when investors are looking for less -risk exposure.

This is because market participants often liquidate their positions in gold to compensate for losses elsewhere, according to FXSTREET.

Gold still maintains its glow in the midst of constant developments in the issue of duties and concerns

Goldman Sachs also increased its prediction for the price of gold at the end of 2025 to $ 3,700 per ounce from $ 3,300, citing stronger than expected demand from central banks and higher inflows to ETFS due to downside risks.

UBS reviews all its forecasts upwards and now sets its main target of $ 3,500, with a higher scenario of $ 3,800 and a « floor » of 3,200.

The gold pounds

The Bank of Greece is not willing to change its pricing policy, maintaining the chaotic difference between the market and the sale of the golden pound and maintaining the cautiousness between private investors. Thus, today the BoG buys the golden pound of the 667.17 euros and sells at 781.80 euros.

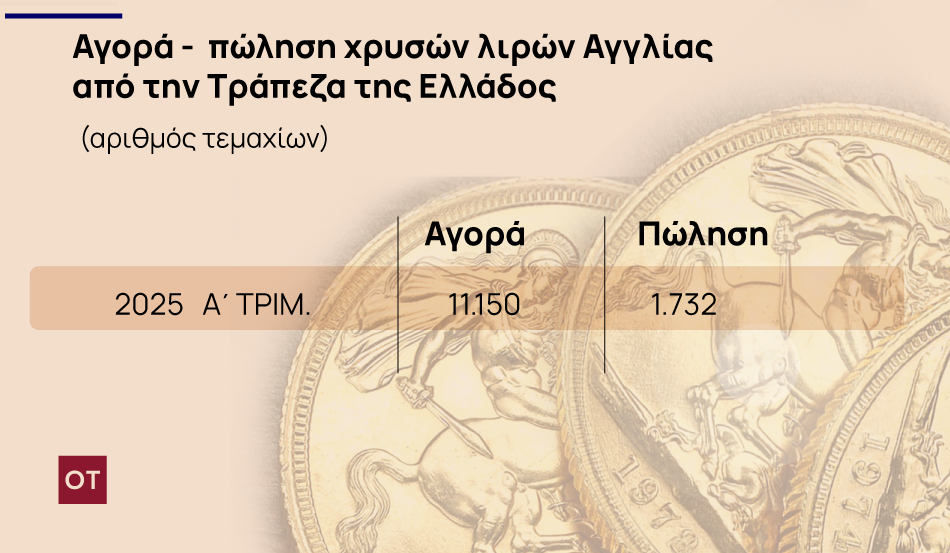

According to Bank of Greece’s data in the first quarter of this year, 11,150 gold pounds were sold, and the purchase of only 1,732 pounds were made.

Which means that the sellers clearly had the lion’s share of all transactions, with their share reaching 87%.

The golden pound, after all, is an investment established in the consciousness of the simple savings as a safe. And most importantly, it does not require specialized capital markets or close monitoring of stock markets.

It is recalled that in 2024 48,328 pounds were liquidated, with estimated revenue for sellers amounting to around € 24.2 million, taking into account average prices.

Compared to 2023 last year’s sales rose 22.6%. Development showing that price rise was considered an opportunity for liquidation.

Source: OT