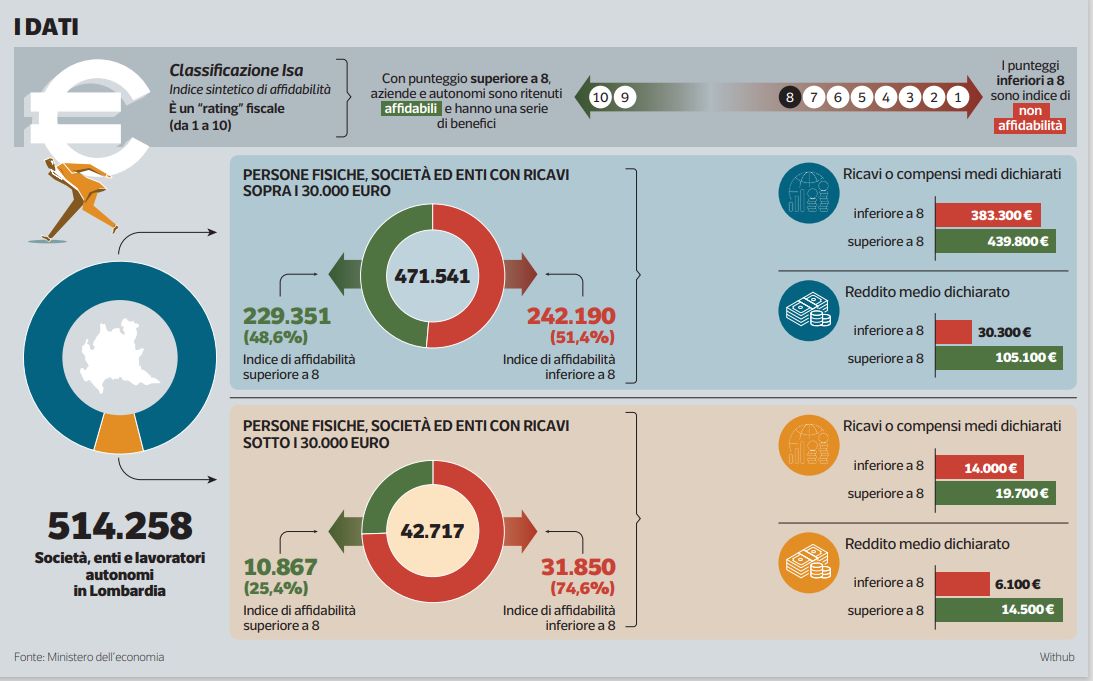

FISCO: in Lombardy « unreliable » companies increase. Over half of the companies declare income under 8% of revenues

Thirty thousand euros on 380 thousand of revenues: evasion risk. The reliable companies report 105 thousand euros out of 440 thousand. The tax report cards of the over 514 thousand VAT matches of Lombardy reveal that more than half have a score that makes them fall within the category of unreliability, or low reliability

A mammoth GDP, over 194 billion euros. The over 514 thousand companies, individual companies and professionals of Lombardy produce it. A varied ocean in which the craftsman, the farmer, the merchant, the large company are included. An imposing part of this ocean, over half, is however very murky: 53.3 percent of the Lombard VAT matches subject to the « tax report cards » of the Revenue Agency is classified as « not reliable ». These are over 274 thousand natural persons, companies and entities. It cannot be said with certainty that they are evaders, it is not wrong to hypothesize that evaders are likely.

Since 2019, the old sector studies have been replaced by the synthetic reliability indices (ISA)a sort of rating that is assigned (score from 1 to 10) based on the information communicated to the Revenue Agency: a score greater than 8 identifies the reliable taxpayer and ensures a series of benefits. Below 8, the subject is not reliable: therefore, net of errors, at least suspicion.

« Honest certificates »

It is obviously impossible to quantify how large and profound the Lombard black stain is, but a comparison between reliable and unreliable reveals abysmal distances.

We start from the companies and the professionals who have submitted declarations considered congruous in 2023 (according to the data just published by the Ministry of Economy and Finance, processed by the courier).

On average, the « honest certificates » declare revenues of about 440 thousand euros and an income of more than 105 thousand: it means that the income amounts on average to 24 percent of the revenue.

This is the proportion for almost 230 thousand taxpayers who have the highest votes on the scale of reliability. And it is the main figure to keep in mind.

The « collapse » of income

First element: The unreliable VAT matches are about 10 thousand more than those that the tax authorities instead consider congruous. On average, these 242 thousand taxpayers declare revenues and remuneration not much lower: over 383 thousand euros.

Here, compared to this « collection », however, they have an average business or self -employment income of 30,300 euros. This is the key point: Reliable companies and professionals declare an income that is about a quarter of the revenues; For unreliable, the income collapses under 8 percent of revenues.

It means that over 240 thousand shops, restaurants, professionals and companies that have a turnover of almost 400 thousand euros produce an income of slightly higher than the Lombard average, or about 27 thousand euros (an average that obviously also includes all other employees). Difficult to estimate what the volume of wealth hidden from the tax can bebut it is certainly a huge river that flows right in the folds of this clear disproportion. In the face of turnover and fees all in all comparable (440 thousand euros, the honest certified, 383 thousand non -reliable), half of the Lombard VAT matches declare a profit of over 100 thousand euros, the other half stops around 30 thousand.

Deepen with the podcast

Minor wealth

A minority fee of tax report cards concerns those who declare revenues of less than 30 thousand euros. It is a much less relevant slice than the entire Lombard Pil (almost 43 thousand VAT games). In this case, however, the percentage of statements deemed incongruous is even higher: 3 out of 4 are unreliable.

The Ministry has not yet released the confused data by province. To enter the Milanese scenario, it can therefore only be referred to the data of the previous year. For revenues of over 400 thousand euros, the autonomous and Milanese companies declared on average an income of not even 23 thousand euroswell below the 34 thousand average euros of Milanese taxpayers. The « honest certificates », compared to a little higher revenues, declared 112 thousand euros instead.

Go to all the news of Milan

<!–

Corriere della Sera è anche su Whatsapp. È sufficiente cliccare qui per iscriversi al canale ed essere sempre aggiornati.–>