Financial adjustments lead impressa trying to sell building

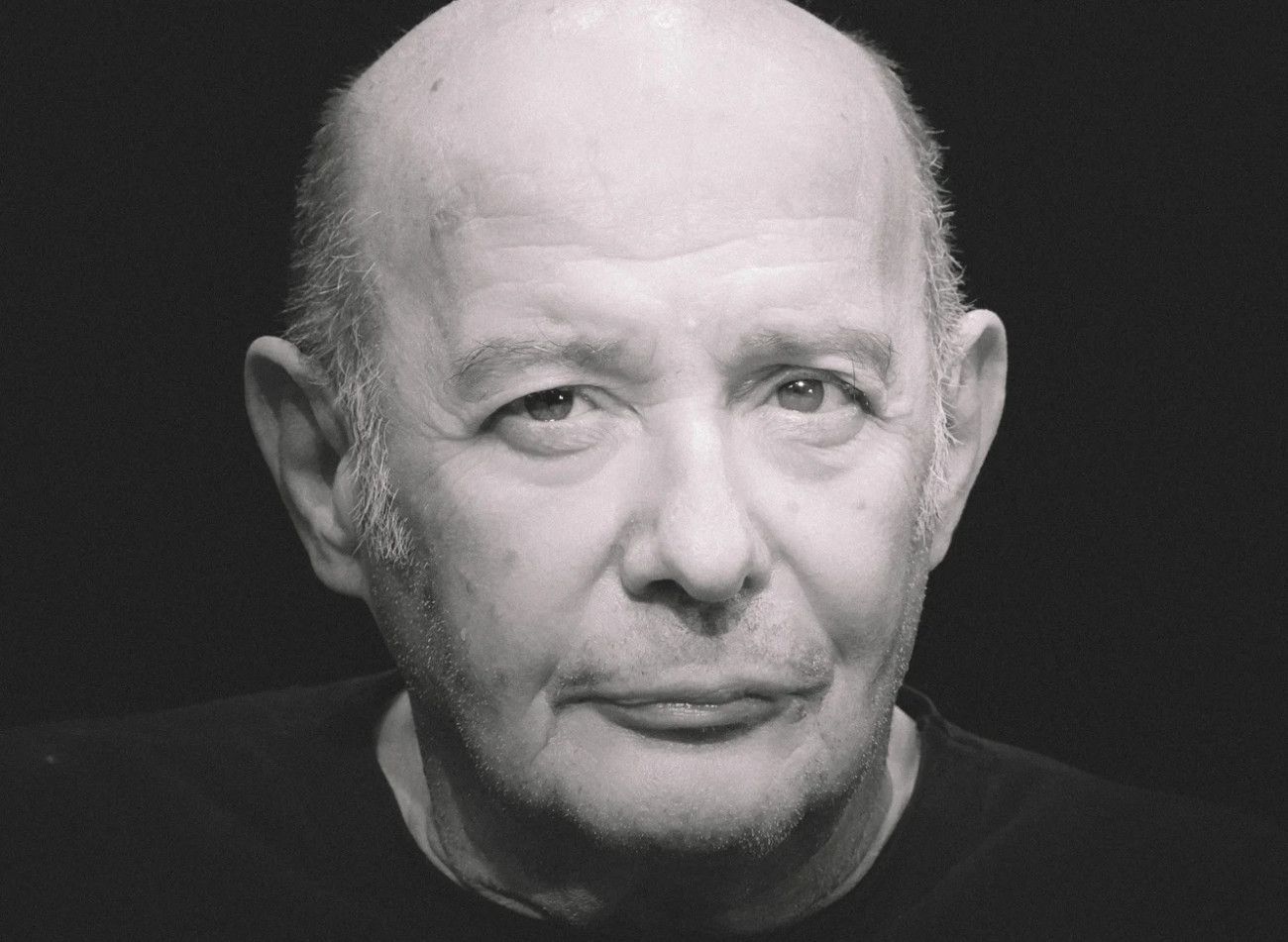

«We are evaluating the possibility of selling the building». This statement by the Pressa Executive President (CEO), Francisco Pedro Balsemão, referring to the group building in Laveiras, Paço de Arcos, may well show the financial situation in which the company of average is found. And you must bear in mind that this is not the first time it happens. The idea is to reduce bank indebtedness. But let’s go to parts.

The possibility of selling and consequent rental of the building had already been assumed by the administration in the statement that advances with the results of 2024 and where it revealed that it had a record loss of 66.2 million euros.

Selling the building is one of the solutions to fit money but not only: the group is implementing a cost base redefinition plan, which will result in a reduction by about 10% over the next four years.

As for the sale of the building in Paço de Arcos, it is not the first time it happens. Impresa sold this building in 2018 and was as a tenant. Four years later, he went back to the bank to which he sold, Novobanco.

This operation is named after leaseback And it is very common in companies that need funding. The good is then owned by the bank and the company pays a installment and may exercise the right of purchase at the end.

Most banks, companies, only do leasings and always has the protection of property, according to an expert to Sunrise. What happens when companies are already owned by a particular heritage and want to finance themselves? The bank suggests, or at their own suggestion, to use that property to support the financing, such an operation leasebackconsidering that the company already owns the property. Then sell the property to the entity and then make a financial lease that, in the end, is a lease-the company is paying a installment. This is the way the group led by Francisco Pinto Balsmanha found to face debts.

But if it is certain that the building will be for sale, it does not apply to titles. The warranty was given by the group CEO. «The company’s main assets are not on sale»said Francisco Pedro Balsemão to Lusa.

But there should be changes: the impression « There is already a set of strategic initiatives to achieve sustained improvement of the operational margin, through greater technological efficiency and organizational structure, simplification and optimization of internal processes, reducing content production costs and permanent reduction in general expenses. »read in the group statement, where it ensures that it is implementing «A plan to redefine its cost base, which will result in a reduction by about 10% over the next four years».

Francisco Pedro Balsemão is aware of the changes that are necessary and defended the need to «Turn the page and start a new cycle after a negative triennium». This is the cost reduction by 2028. But the Impresa CEO left the warranty: «We have no purpose here in terms of headcountnumber of people who will leave ».