Fewer hurdles on the way to the home

« The chimneys no longer smoke as before, » says Guy Hoffmann, the chairman of the Raiffeisenbank board of directors, on Tuesday at the presentation of the balance for 2024. However, they did not go out. Guy Hoffmann was satisfied with the past financial year. Raiffeisenbank was able to increase its net result by ten percent compared to the previous year to 28.1 million euros.

The past year was not a calm. « We walk through a time that is shaped by many uncertainties, » says Hoffmann. The geopolitical tensions in the east of Europe, the uncertainty on the financial markets, the interest steps of the central banks – all of this has direct influence on the finances of the Luxembourgers and the business of the cooperative bank.

Guy Hoffmann, the chairman of the Raiffeisenbank board of directors, is satisfied with the 2024 financial year. Photo: Guy Jallay / LW Archive

« We were able to observe a tentative revitalization of the business, » says Hoffmann. From July 2022, the central bank began to increase the interest rate. In mid -2024 he peaked at 4.5 percent. In this context, Guy Hoffmann explains that the idea that the key interest rate is closely connected to the interest for real estate loans in Luxembourg was not entirely correct. It was correct that the construction interest rates rise when the key interest rate increases, but there are other variables that determine the amount of the real estate interest. Borrows can breathe a sigh of relief since June 6 of last year. At that time, the European Central Bank announced that it would reduce interest rates. As a result, the construction interest also dropped.

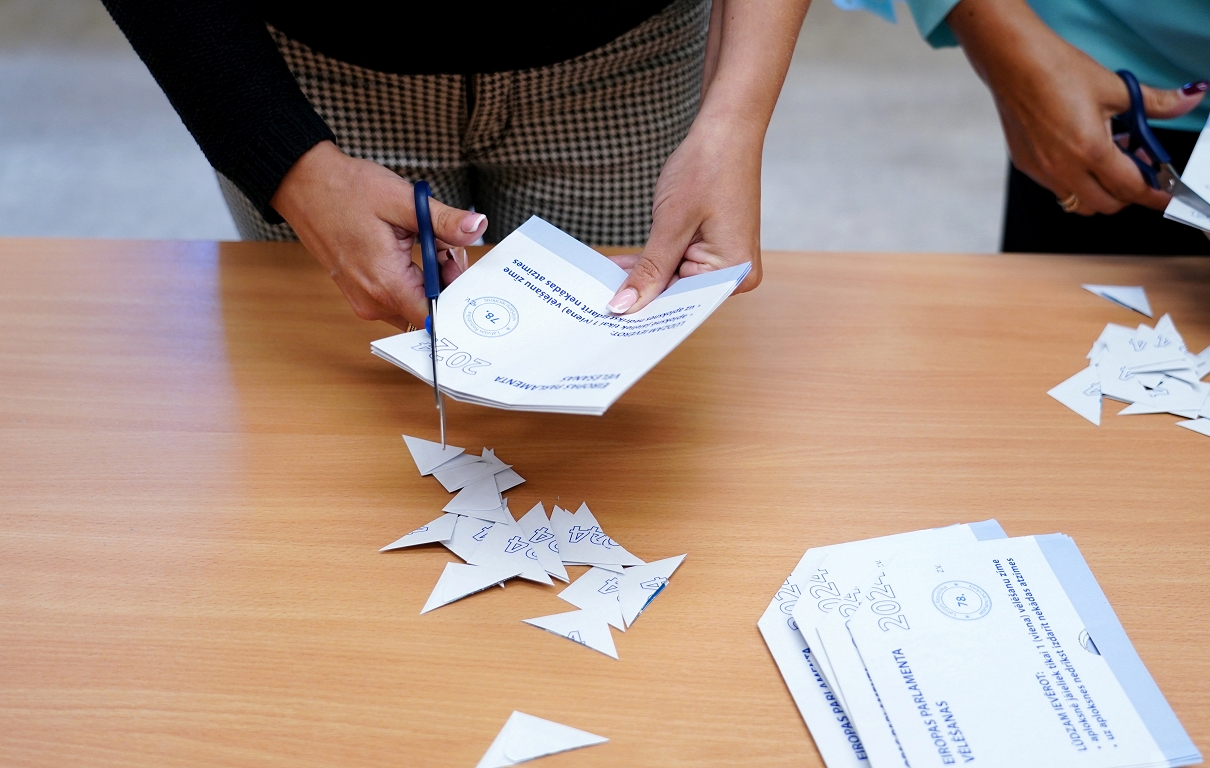

First signs of an upswing on the real estate market

« Customers who have been living with the in -laws for two years now put pressure on, » says Hoffmann. For a long time, the interested parties would have waited for better times that seem to have come. « The bike begins to turn again, » says Laurent, a member of the management board, expresses. « The real estate market shows the first sign of relaxation, » he continues. However, the bank does not expect the building interest rates to be « dramatically changed » this year.

The real estate market shows the first sign of relaxation.

Laurent pay

Directorate member of the Raiffeisenbank

The prices for existing apartments and houses have ended their descent and stabilized – without having reached the previous crisis level. This does not apply to the new building. Many projects are still on ice and are not realized, for example because the building land was bought before the crisis and the project no longer pays off. Raiffeisenbank recorded growth of 2.2 percent throughout the year. The bankers are also optimistic about the first two months of 2025 that this trend could continue.

With 22 to your own home: How Sabrina and Gustavo financed your house in Luxembourg

The money that the Luxembourgers could not invest in real estate ended up in the banks’ savings accounts. 420 million euros more than in 2023 brought private customers to Raiffeisenbank, an increase of almost seven percent. Despite the many uncertainties, companies in Luxembourg also earned money. They were able to increase their deposits by 328 million euros. « The deposits of private customers and companies amount to almost exactly ten billion euros, which corresponds to an increase of almost 750 million euros, » says Laurent.

But not only the income could be increased, the expenses were also higher than in the previous year. « We have hired 24 new employees, and the index tranches have also contributed to the fact that personnel costs have increased by seven percent, » says Guy Hoffmann. The bank found that the employees are very satisfied with their employer. « We carried out a comprehensive internal survey in 2024, the results were very positive, » says the director. 84.7 percent of employees would recommend their employer.

Customer deposits break through the 10 billion mark for the first time

The bottom line was that Raiffeisenbank successfully completed the 2024 financial year. It speaks of a « ordinary result » of 28.1 million euros. In direct comparison to the previous year, the net result did not increase. At that time, the company had separated from participation, explains Hoffmann the reason. This transaction brought 18.4 million euros. « If you calculate this post, the result was higher in 2024 than in the previous year, » says Hoffmann.

The bank could say what happens to the millions. On this point, the Raiffeisenbank differs from others: « As a cooperative bank, we do not pour our profits to shareholders, but put them into our company and the local economy, » says Guy Hoffmann.