Europe: In which countries the investment in real estate will be more efficient this year

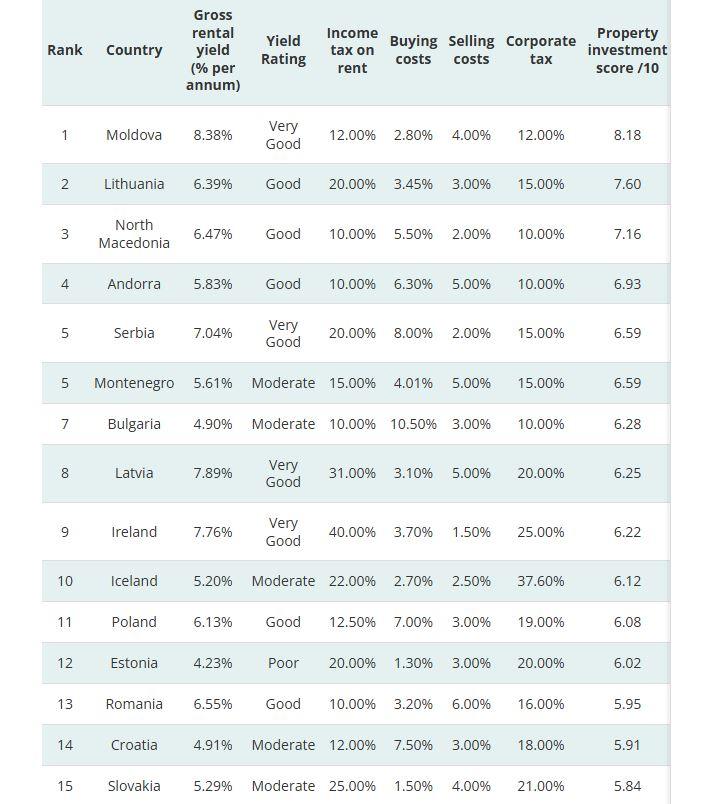

The best European countries for investment in real estate In 2025 they are in Central and Eastern Europe, with the first one country – surprise: Moldova.

The Balkan country has earned the highest score in a new study that detects the best real estate investment in Europe, according to the British insurance company William Russell, which examined basic real estate investment data, including real estate tax rates, income tax tax and income tax.

In a previous study by the British company 1st Move International, Lithuania appeared as the top choice. On the current list, the Northern European country won second place, followed closely by Northern Macedonia.

Moldova was described as « a emerging, high -performance market for tolerant risk investors » in the study, which found that the cost of buying real estate is at most 2.80% of the price and the income tax is 12% on rent, providing high rent.

The country has won a high rankings due to its capital, Chisinau, which has developed steady growth in the areas of infrastructure, hospitality and business in recent years.

This, coupled with the increase in tourism, due to the country’s winery and cultural heritage, offers short -term leasing opportunities.

However, Moldova is not a member of the EU at present, as it is a candidate to join the block.

Rentals in European countries in 2025

Lithuania is classified as the country with the second best opportunities for real estate investment in Europe.

Real estate prices have jumped by almost 10% in the last three months of 2024 on a yearly basis, according to Eurostat, and this trend is likely to continue.

Despite the sharp increase in real estate prices in recent years in the country, the location is attractive to foreigners, as the real estate market in Lithuania is not limited. Rental prices also attract investments because they are high – over 170% compared to 2015.

« With gross rental rented about 6.39% per year and a maximum purchase cost of 4.10%, Lithuania’s moderate growth rate means that property prices are likely to grow steadily over time, providing a good return on investment, » the report said.

Northern Macedonia, another candidate to join the EU country, was classified as the third best choice. The capital, Skopje, is aware of urban development, infrastructure upgrading and increasing demand for residential and commercial sites.

The country offers low taxation, combined with a simplified real estate acquisition process, and there are government incentives for foreign investment. According to the report, Northern Macedonia can also boast about 6.47% per year, which indicates strong performance in relation to the value of the property.

Where else in Europe are there good opportunities for real estate investment?

According to the study in question, which Posts EuronewsSerbia, Ireland and Latvia also promise « very good » returns, with gross annual rentals exceeding 7%.

In Ireland, high returns are mainly secured by high rental prices, but increased taxes could reduce annual net income. The country is facing a housing crisis, as no enough homes are being built for the growing population, as prices continue to rise.

Greece ranks 28th among the 36 countries examined by the study, with rentals for 2025 amounting to 4.73%, a low performance mainly due to high taxation.

Countries with the highest gross rental returns, coupled with relatively low average rental tax, include Andorra, Montenegro and Bulgaria.

Despite the slightly higher tax rate (21%), Italy has the third higher rent rate due to high yields (7.56%), which may be attractive depending on the specific investment targets.

« While gross rentals and the average tax rate of rent by rents are important factors in real estate investment analysis, it is vital to take into account other factors, such as vacant housing rates, property management costs and local market conditions. »