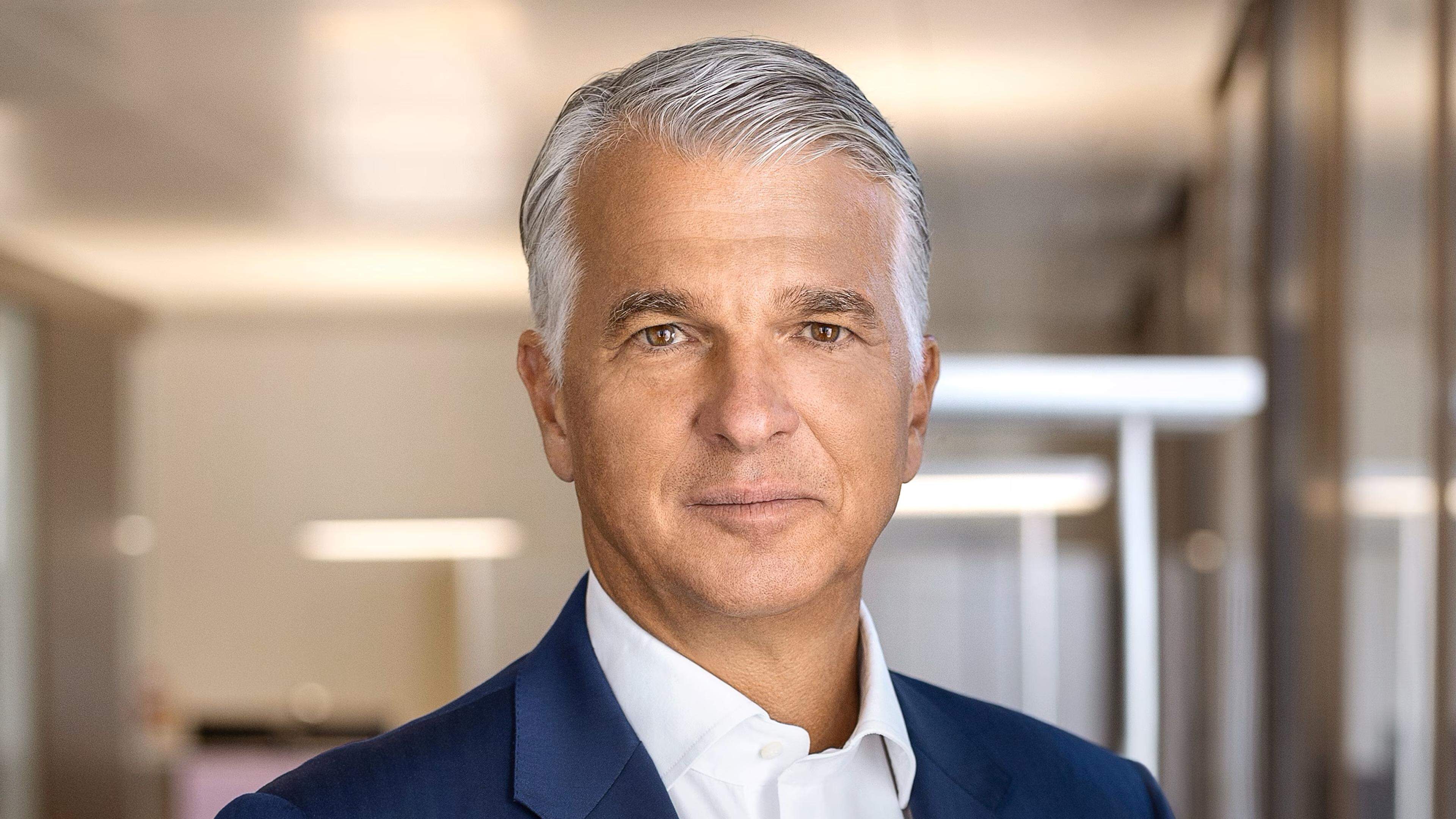

Ermotti is Europe’s best paid bank boss

Sergio Ermotti received a total remuneration of CHF 14.9 million (CHF 15.6 million) for 2024, which, according to Bloomberg News calculations, is significantly higher than the average income of the CEOs of the ten largest banks in the region. With 13.2 million euros, Orcel was not far behind, thanks to an increase of 32 percent – the strongest among his colleagues.

Many banks in Europe achieved record profits last year due to higher interest rates, which enabled them to increase the distributions to investors. Her share prices generally rose sharply, with the rally accelerating in the first quarter of 2025.

Ermotti and Orcel got into the criticism of investors because of their salaries. UBS and Unicredit argued that the remuneration packages were justified and referred to the company’s performance, benchmark comparisons and the strong competition for talents.

Increasing profitability

« This adaptation is necessary to promote the long-term commitment of a top CEO in a competitive market, » said Unicredit in a statement on her website and thus reacted to the criticism of the voting right advisor ISS in the increase in orcel content. The bank said that under Orcel leadership she had recorded an « extraordinary profit growth ».

Unicredit said that « she would ensure the adults to the benchmarks of the other banks, including the British banks », which no longer have to stick to an EU upper limit for bonuses in relation to fixed salaries. The Unicredit annual general meeting approved the remuneration policy.

UBS has set Ermotti’s salary lower for 2024 than the internal rules allowed. The remuneration of bankers is currently under intensive observation in Switzerland. Ermotti has so far advanced the integration of Credit Suisse without any major problems. At the same time, the bank is in a discussion with the government about its future capital resources.

Dependence on the stock prices

The majority of the Ermotti and Orcel’s remuneration is bound in long-term incentive plans, which means that they will not receive the money immediately. The final value of the premiums can change depending on the company’s share prices.

Orcel headed UBS’s investment banking during Ermotti’s first term as CEO of Swiss Bank from 2011 to 2020. Ermotti returned to the post two years ago, shortly after the UBS had approved the takeover of Swiss Rival Credit Suisse as part of a state rescue operation.

Much of the increased remuneration was in investment banking.

The increasing profitability of European banks has also enabled them to pay their other employees higher bonuses, with the pools for variable remuneration in most cases increased. Deutsche Bank recorded one of the largest growth in the total of the bonuses granted for the past year, which increased by 26 percent in the greatest level in ten years compared to the previous year.

Much of the increased remuneration was in investment banking, which had a strong year. This has led to a growing number of income millionaires at the banks. However, the number varies greatly between the individual money houses, which depends above all on how much you rely on investment banking to generate income.

At the end of the remuneration list …

Philippe Brassac, CEO of the Credit Agricole, and ING boss Steven van Rijswijk are at the end of the remuneration list for the CEOs of the ten largest European banks. Both companies depend to a comparatively little extent on the investment banking business.

Luxurious lifestyle and unpaid workers

As a Dutch bank, the ING is also subject to a strict bonus limit under national law. The institute explained that it has a hard time fighting talent in competition with technology companies.

/s3/static.nrc.nl/images/gn4/stripped/data133212332-41b949.jpg)