EBEP: The impact on the Greek economy by the Israel-Iran conflict

The jump in oil prices, shortly after Israel’s missile attack on Iran, before Tehran even responds, is a foresight from what will follow at the financial level.

Vassilis Korkidis, president of the Piraeus Chamber of Commerce (EBEP), today issued a new updated information note on the economic impact of Israel-Jran war conflict on the international and Greek economy.

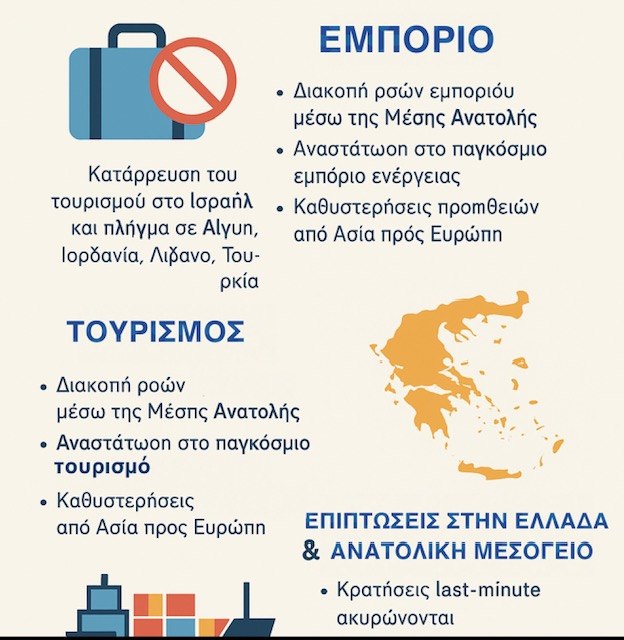

According to the EBEP analysis, in terms of Greece, the most significant impacts of a scaling in the Middle East conflict focus on five key areas: tourism, shipping, trade, energy costs and geopolitical stability.

Source: EBEP

Blow to tourism

As the conflicts are extended, tourism is increasing throughout the Eastern Mediterranean basin. The risk is greater for cruise tourism of so -called « multipurpose », with packages that include stops in ports and excursions to many countries – eg. Greece – Turkey – Israel – Egypt.

Greece can be considered a « neighboring zone of instability », especially by third -country visitors, e.g. from the US and Asia.

Even if there are no immediate cancellations of tourist packages, it is almost certain that there will be an increase in insurance coverage for travel providers.

Greek shipping

The key strategic position on everyone’s lips, not just those who deal with shipping, is the straits of the hormoz.

It is a narrow strip of water between Iran and Oman, from which the world’s oil consumption passes daily.

The new information that Iran is seriously considering closing the straits of the hormone, rejuvenates fears that the worst scenario can become a reality.

Even if the straits of the hormoz are not completely closed, possible attacks or involvement in the Red Sea, they will disrupt international and Greek shipping.

As far as Greek -owned shipping companies are concerned, EBEP considers the rise in operating costs and increased charter pressure.

There will be an increase in fares and premiums and Rerouting, rearrangement of ship routes, through the Cape of Good Hope in Africa. Similarly, the delivery times will be extended and reducing the reliability of logistics systems

Trade & Import Distribution

Delays in the delivery of goods from Asia through Suez have a direct impact on logistics, processing and retail.

In this case, it is considered a given to increase the cost of imports in Greece, especially in energy, raw materials, and technological products.

In addition to increases in prices of imported goods, insecurity is also prevalent for exports of Greek products, in the countries of the Middle East and North Africa.

Energy Disruption – Fuel costs

Increasing oil and gas prices will have a direct impact on transport – road, ferry and airline.

Greek households are afraid of burden on domestic heating and electricity, while inflation, especially in food and energy, will get uphill again.

Geopolitical and diplomatic pressure

The EBEP is restrained in its geopolitical estimates of the role of Greece.

He believes that « the pressure on Greece will intensify to maintain a balance between the US, Israel and Arab countries ».

The positive counts the possible « reinforcement of Greece’s role as an energy and geopolitical hub (LNG, EastMed).

There will also be upgrading the tension in the field of defense, with a possible increase in military surveillance in the Aegean and Cyprus.

Source

Estimated financial losses for Greece

EBEP is running a moderate scenario, extending the crisis in the Middle East for the next quarter, with intense geopolitical instability and uncertainty.

Even without a general war, there will be holidays in trade and energy flow. Greece is indirectly influenced, not directly by military operations.

- Tourism will be directly affected, as it is a predominantly sensitive sector in ‘security perception’. In the event of a three-month crisis, it is possible to cancel 10% -15% of arrivals, with loss of loss of 600 to 800 million euro and -6% reduction in annual tourism expenses

- In the energy sector there will be the highest financial costs, due to Greece’s dependence on imports. EBEP examines the 20%of oil and gas prices rising scenario, which corresponds to Increase EUR 1 billion in energy importswith 0.4% GDP burden.

- Shipping sees cost increases, but it can take part of it to the fare. Increase in insurance costs and Rerouting has an estimated additional operating cost from 300 to EUR 500 million, with a -1% reduction in net revenue of the fleet of Greek navigation.

- Trade will be affected multiple due to transport delays and increased import costs. EBEP’s intermediate scenario raises the burden on 200-300 million eurosby increasing the cost of imports from Asia by 5%to 7%.

Overall, in the scenario of the three-month escalation of Israel-Iran war conflict, the estimated Financial losses for Greece are 2.1 to 2.6 billion. euro -and GDP drop by -1%.