Dice, Trump has declared the world economic war (and is already losing it). But what does Europe do?

Many countries have sniffed Trump’s weakness and are betting on it. Canada has taken the path of the utmost intransigence in retaliation and China does not just impose counter-tooth

This article is based on the weekly newsletter « Whatever it Takes » by Federico Fubini. To register and receive it every week in the email box This is the link

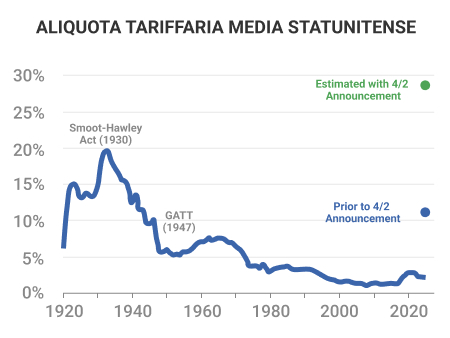

The week opens under wishes that is anything but positive for Donald Trump. THE financial marketsbut not only that, they indicate that the highest tariff wall ever raised by the United States in the last century and beyond (as the graph below shows) has been too daring a step. The American society first does not seem able to support it. Meanwhile, China is taking countermeasures that go beyond The retaliation already announced with customs withdrawals at 34% on American products. Signs emerge that the White House could be directed towards a defeat, in its protectionist bet. The latter will not be easy to withdraw, especially after having raised the mail so much. But the growing weakness of Trump’s position should enter the calculation, orthat Europe and Italy wonder whether to rebel or suffer: whether to respond hard or try above all to avoid an escalation.

(Do not hesitate to write me: comments or disputes and proposals).

The two Americas

We arrived here because they exist, of course, at least two Americas: the first convinced of having little to do and a lot to lose with globalization; The second instead closely linked to it for their growing wealth of these years.

The first is America that has undergone the costs of over forty years of growing commercial deficits on its skin, especially in the products. The economist Richard Koo of the Nomura Research Institute showed in the Teha workshop of Cernobbio of the past few days how, from 1980 to 2023, the United States have accumulated a red in the exchanges of foreign goods equal to over 150% of their gross intelligence. Masses on each other, those commercial deficits are worth something like 42 thousand billion in today’s dollars. Out of hyperbolic figures, These are the relocations towards China and to Mexico of steel or car systems, the deindustrialization of Rust Belt and an infinite number of other production areasthe loss of dignity of those who do not have a college diploma. In other words, as now known, these are Trump’s voters. They are 38% of Americans who do not have shares listed on the New York Stock Exchange and have nothing but debts: on the house, on the credit card or for having sent the child to college. They are those who make the cost of interests on debts for families in the United States are 10% of the income available, according to the Citadel investment fund. Every ten dollars in his pocket, one goes to pay only the interest on the debts contracted to move forward. But this is an improper average on the whole population: for that 38% that has no savings to invest in the stock exchange, the share of interest on debts weighs on income available certainly more than a single dollar every ten. These people have to pay houses that since 1980 have come 96% in real terms (i.e. eliminated the inflation effect)-according to Richard Koo’s estimates-while their wages have since grown less than 15%.

This part of America does not matter if the Wall Street indices collapse due to the duties, because in any case it does not have Amazon, Microsoft, Tesla or any other company actions. This indebted and without savings America appreciates another financial aspect linked to Trump: since he returned to the White House, the cost of their debts has fallen, because the performance of the US Treasury securities has fallen; This seemed to be started at 5% on ten -year deadlines when Trump was preparing for the oath ceremony last January, but now it is below 4%.

What escapes, is that this decrease in the cost of debt is not due to the restoration of the accounts. It is due to the recessive climate established in the country.

Thus, what Trump did by raising a wall on the rest of the world seems to be made to measure for this reason cut out of even a minimum seal of sharing in Wall Street. Trump is trying to push industrial companies around the world to revive themselves in the United States in order to avoid duties; He is trying to reduce commercial deficits and restore dignified work to those who had lost it. We will see better below that it is not the right way, but this 38% of disadvantaged Americans appreciate because those who have voted for them have done it for that.

Who has shares at Wall Street

Then there is the other America: 62% of the population holding shares listed on Wall Street. They are 162 million Americans. Since Trump’s oath day, according to my calculations, these people have lost 47,500 dollars of savings on average for each due to the collapses of the bags. This also applies to the many tens of millions of Americans who are exposed to equity indices only because their pension funds are largely invested in them.

It must be said that the averages in this case are insignificant, because 93% of those shares listed on Wall Street and held by investors in America (for a value of about 48 thousand billion dollars to its maximums) is found in the hands of just a tenth of the population. The remaining about half of the residents of the United States, which have investments in the stock exchange, controls in all just 7% of those 48 thousand billion dollars.

It should be noted that this America with shares in the savings accounts – especially the richest 10% – unlike the disinherited have not undergone any damage from commercial deficits on goods: deindustrialisation does not concern them because they are doctors, lawyers, people of finance, technology or university. On the contrary, they took advantage of the growing surplus of the United States in digital services with the rest of the world (reached 128 billion euros with the euro area in 2023). In fact, these people have Amazon, Nvidia, Microsoft, Facebook-Meta or Google-Alphabet actions or maybe they work for those giants, which partly make their turnover abroad.

It is not surprising that these two Americas – the one with bank debts and the one with Wall Street actions – see the rest of the world in a totally different way. At the first America it does not care, in the second yes. The first America operates mainly in non -specialized local services and is the protagonist of the largest economy in the world: foreign trade for the United States is just 25% of GDP, compared to 66% of Italy, 45% of Japan and 37% of China. The second America, on the other hand, depends for its wealth on the fortune of the companies listed on Wall Street, where four dollars every ten of the groups of the S&P500 is earned abroad (for technological companies it is even more).

In essence, two different worlds coexist in America, with opposite perceptions. In raising the wall of the duties, Trump wanted to do the interests of the weaker part: the victims and not the winners of globalization.

The industrial goal

Joe Biden also tried, but there was a difference: the Democratic President tried to pay the reindustrialization of the country with American public money, financing large subsidized plans from tax credits such as the inflation vection act on green technologies or chips act on semiconductors; The republican president, on the other hand, tries to make American reindustrialization pay the rest of the world, imposing his duties.

It cannot work. It will fail because a Trump recession is almost inevitable if the president does not go back. Why almost inevitable? Because the first America – the poorest – will be severely affected by inflation on imported and more expensive assets by duties, therefore it will cut its consumption. Even the second America who is invested in Wall Street will be affected by inflation, but in the meantime it is already an average collapse of its patrimonial wealth – precisely – of $ 47,500 per head so far; As a result, the second America will certainly tighten the belt.

But consumption represent well over two thirds of the American economy. Their recession can only bring straight rights an all -round American recession, as well as bad news for the rest of the world: the American consumer, alone, runs almost a fifth of the entire international economy. So the bags would still fall, aggravating the recessive effect.

Betting against Tycoon

All this makes me think that Trump at this moment is politically a dead man who walks, even if maybe he doesn’t know. We certainly cannot give it for lost, because it has already shown that it knows how to invent other resurrections. But other countries have sniffed his weakness and are betting on it. Mark Carry’s Canada, despite the great risks, has taken the path of the utmost intransigence in retaliation and is already obtaining results already. And China, who has long been selling the great part of its products outside the United States, has not limited itself to imposing its counter-to-date to 34%. Last Thursday, the Central Bank of Beijing suddenly announced that it widens its system of international payments surveyed on the digital yuan to the ten countries of the Asean (the group of Asian commercial powers) and six countries in the Middle East. In fact, for the first time Beijing disappointment is the SWIFT Payment System directed by American – which had dominated the world so far – thanks to a much faster and efficient digital system. It already covers 38% of world exchanges, while the United States isolation.

In fact, China called Trump’s bluff and thus did the Canadian Carney. The White House is in enormous difficulty and will probably have to give in, at least a lot. Only in Europe and above all in Italy do we seem to have not understood it and prefer to do as little as possible.

Readers’ feedback is important, your « recommendation » as well. If you liked this newsletter, tell friends to subscribe! If you want to write me, this is my email: ffubini@corriere.it