Curling the market of trucks in Russia reaches peak values

The rapid increase in the import of Chinese trucks to Russia led to the overstator of warehouses by analogy with cars. Automobile manufacturers from China and importers miscalculated in assessing demand: after record sales over the past two years, the market has fallen to decline, and the situation was aggravated by the high key rate of the Central Bank. Experts predict a drop in sales by at least 15%, but the restoration of demand in the fourth quarter is not excluded, especially when softening monetary policy (DCP).

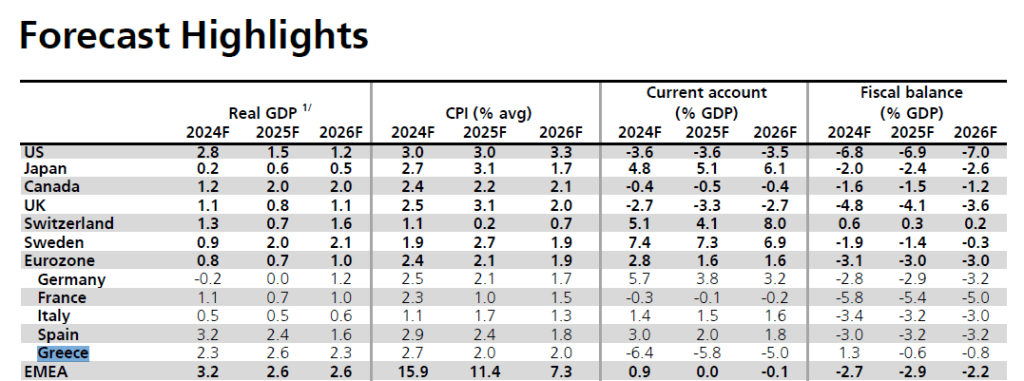

Incutation in the truck market in Russia reaches peak values: the volume of effluents is up to 60 thousand units, the dealers, analysts surveyed by Kommersant reports, and also testify to the data of the market participants. It will take about nine months to sell stocks, or even a whole year, experts say. “If you focus on the current market forecast, that is, sales of 60–65 thousand cars this year, then you can not produce anything at all – all these cars are already there,” the CAMAZ CEO Sergey Kogogin (quote for the corporate publication Vesti KamAZ) evaluates the situation.

According to the general director of Avtostat, Sergei Tselikov, in particular, the miscalculation led to the supplies from Chinese automakers who actively carried their products after the departure of Western brands from the Russian Federation, when the need for tractors increased due to adaptive logistics. In 2023–2024, according to the agency, the sales of large -capacity trucks against a background of high demand reached 125.66 thousand and 102 thousand pieces, respectively. “The Chinese did not plan anything and brought so much that when the market wave was over, there were extremely many trucks,” the expert summarizes.

Kommersant sources in the market add that in the cargo segment in Chinese brands there is chaos with distribution: the number of distributors in one brand can reach ten pieces (while by cars, as a rule, one) makes centralized supplies impossible. The Executive Director of Stork LLC (the official representative of DAYUN in the Russian Federation) Arthur Soldatkin adds that the acceleration of freight imports in the pretext of raising utilsbor – in October 2024 and in January 2025 also affected.

The situation with demand was aggravated by a slowdown in the construction sector and the growth of the key rate of the Central Bank: according to Mr. Tselikov, about 75% of the truck market – leasing transactions.

And with a high “key”, the content of the leasing car becomes economically inappropriate, explains Dmitry Shelgunov, head of the SIV Transholod key clients. “Everyone who is now facing the choice“ buy a new car or travel on the old ”chooses the second option. Even those who have money put it in a bank on a deposit – when will it still have the opportunity to receive income without doing anything? ” – Comments the influence of the high rate Mr. Kogogin. Maxim Kadakov, editor -in -chief of the magazine behind the wheel, adds: due to the hard DCP, the business as a whole “freezes” construction projects and reduces the volume of transportation. “That is, the point is not just that the trucks have become expensive. If you need a car for business, you will buy it anyway, ”the expert is sure.

According to KAMAZ analysts, at the beginning of 2025, about 40 thousand Chinese cars remained non -distributed in warehouses. The reserves of the car manufacturer himself, according to the company’s reporting, at that time in monetary terms, amounted to 87.08 billion rubles, which is 2.3 times more than a year earlier. “Clients returned about 20 thousand cars to leasing companies – also mainly imported from the east,” they add in Kamaz.

Vyacheslav Mikhailov, director of the Gazprombank Leasing Business Development Department, estimates the total reserves of leasing companies in cargo equipment of 15 thousand, and the total runoff is 30 thousand units. Mr. Soldatkin believes that the drains of dealers and importers on Chinese trucks reach about 45 thousand pieces. The head of the sales sales department of LLC MZ Tonar, Artem Savushkin, believes that the reserves of distributors and dealers are about 25 thousand tractors and 20 thousand chassis and dump trucks. “All equipment was brought under an increase in a recycling fee in October 2024. And in the coming year, it is not planned to import more than 12 tons, ”he notes.

The market for heavy trucks of the current year and analysts evaluate pessimistic.

According to Sergei Tselikov, sales in the segment for a year by a year can be reduced by 30–35%. Maxim Kadakov believes that at best, the fall will be 15–20%. At the same time, according to the expert, the revitalization of demand is not excluded in the fourth quarter when softening the DCP. Large discounts on trucks – as happened in the passenger segment against the backdrop of overstocking (See “Kommersant” from March 26) – It is unlikely that Mr. Kadakov summarizes, summarizes: rather, we will talk about more favorable leasing conditions. According to the results of the two months of this year, 8.8 thousand large -capacity trucks were sold in Russia, which is 41% less than a year earlier, according to Avtostat.