Crac of Venetian popular banks, 41 thousand creditors ask 5.6 billion from liquidators

After seven years, credits for 2.4 billion were admitted. But nobody will see a euro

Crash of the former popularthe liquidators close the accounts with admitted creditors. Over 41 thousand requests for insinuation for 5.6 billion eurosadmitted only for less than half, 2.4 billion. And a conclusion: on these credits, with all probabilitynobody will see a euro. Almost eight years after the liquidations of Banca Popolare di Vicenza and Veneto Banca, on June 25, 2017, has paradoxical outlines the outcome of the mammoth work carried out by the liquidating commissioners, left on February 22, 2018 and went on for over seven years, of the editorial staff of the passive state. The commissioners (Giustino di Cecco, Claudio Ferrario and Francesco Schiavone Panni for Bpvi, Alessandro Leproux, Giuliana Scognamiglio and Giuseppe Vidau for Veneto Banca) communicated the closing of the work with relationships Parallel dated 20 March, the day on which the passive states were filed with the courts of Vicenza and Treviso and in the Bank of Italy.

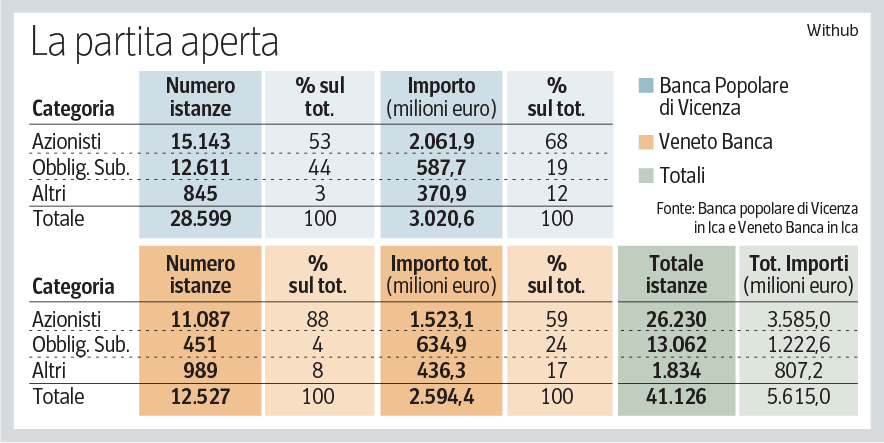

The numbers

Parallel work has led to different results in numbers. In the case of BPVI, over 28 thousand requests for insinuation to the passive, for 3 billion euros (2,8 the unsecured credits, 196 million privileged, 2 million in prededuction), for just over half – 15 thousand requests for 2 billion, 70% of the total – on claims of shareholders linked to violations on the sale of actions. But in Vicenza there are also many requests for subordinate bondholders, over 12 thousand for 587 million; 845 the requests of other creditors, for 370 million, 12% of the total. In Veneto Banca, the insinuation requests are less than half of Vicenza, 12,527 for 2.6 billion. The practices of the shareholders, 11 thousand, in the case of Montebelluna are 88% of the total, but only 59% of the amount, 1.5 billion. Opposite, compared to Vicenza, the picture on bonds: only 451 questions, but with an amount higher than Vicenza, 635 million; 436 the millions requested by the other creditors, with almost a thousand questions.

Excluded and admitted

The liquidators’ scarce excluded The requests of the members who had signed the tomb transaction with the 2017 banks. In the evaluation of the shares, taking into account the purchase period, between January 1, 2013 and March 31, 2015, including capital increases. The result, in the case of Bpvi, excluded 1.6 billion of credits, making them enter 1.4: 1.2 those allowed (6.3 million with privilege, 636 million unsecured, 577 million post -posted unsections), 198 million admitted with reserve. In the case of Veneto Bancaexcluding 1.5 billion credits. 993 million (9.5 with privilege, 353 chirografi, 630 post -poster were admitted) and 33 million with reserve, for 1,028 million total.

The oppositions

The excluded now have 15 days from receipt of communication to oppose. In any case from liquidation the creditors Nothing can be expected, as the commissioners have already written several times in annual relations, using the formula that « concrete prospects for satisfying creditors » other than understanding and the state are not recognizable. This, in particular, For the figures that liquidations will have to repaywith the recovery of deteriorated credits, in agreement and in the state before the unsecured credits, according to the provisions of the liquidation law. It happens for loans, guaranteed by the state, granted by understanding to liquidations Immediately after the departure of the management, 3.2 billion in the case of Vicenza and 3.1 in that of Montebelluna. 2,4 and 2.3 billion of renovation and capital contributions are added at the time of the data liquidation in agreement (that the two banks had taken) by the State, and who had given them to be recovered to the liquidators.

Loans

Finally on the account there are the loans made by Intended to liquidations to be repaid Credits relegated as deteriorated after the end of the banks: 621 million in Vicenza, 334 in Montebelluna. In all, the account to be returned, before the creditors, is 11.9 billion: 6.2 for Bpvi and 5.7 for Veneto Banca. In Veneto Banca, the commissioners had already communicated That the management, until 2022, out of 6 billion assets, had recovered 2.2, 2 of which are gone to understanding. It remains a heritage of 1.8 billion.

Go to all the news of Venice Mestre

<!–

Corriere della Sera è anche su Whatsapp. È sufficiente cliccare qui per iscriversi al canale ed essere sempre aggiornati.–>