But did the taxes go down? No, there is an « invisible »: that’s why workers are poorer (while the state accounts improve)

Why is public finance well, employment also yet the work in Italy is increasingly poor, despite a cut of taxes on the 17.6 billion paycheck in recent years?

(This article is based on the weekly newsletter « Whatever it Takes » by Federico Fubini. To register This is the link)

Not all of the destinies of our country is decided at the negotiating tables of Brussels, Washington, Chinese factories or Wall Street trading desks and London City. Fortunately, a large part of our well -being is still in our hands, depends on our choices.

And this is where some questions arise.

Because public finance is fine, employment too. Nevertheless Work in Italy is increasingly poordespite a Tax cutting on the paycheck from 17.6 billion in recent years?

What is it that doesn’t square? Are there invisible taxes, of which we do not notice but that we pay to make ends meet? And is there an Italian anomaly, in the international confrontation?

The answer, unfortunately, is a double yes: There are invisible fees and there is an Italian anomaly. And both of these factors contribute to explain why work in Italy is so poor, while the state accounts improve. We see.

The data of the World Bank you see above concerns a turnaround after a quarter of a century. In Italy at least since the early 60s, but probably from before, it has always been invested little in research and development. In proportion to the dimensions of the respective economies, half of the international average is made in this item, almost half compared to France, half of China, practically a third compared to Germany and the United States. Of course, a basic reason for low wages is there: little innovation in business life and products, few qualified and productive jobs; They have been focusing on fire for some time.

What the PNRR would be for

Since they are, you will think: what is being done to remedy? Well, wrong question. The right question is: why are we further worsening? The graph over shows that The expenditure in research and development in Italy – in the era of artificial intelligence, robotics, space, biotech, fintech, semiconductors, quantum computing, batteries, electricity cars, green technologies and much more – has taken to decrease since the year 2020. For the first time for decades, constantly. Eurostat tells us that it is now falling at least until 2023, down just 1.31% of the gross product (GDP). We are one of the last countries of the European Union, behind Hungary and Greece. The national recovery plan (PNRR) does not seem to have had effect, on the contrary.

Research and development: virtuous choices

Note that instead China reacted to the wave of commercial war during Donald Trump’s first mandate accelerating on research and developmentfrom 2018-2019, to make oneself self -sufficient for example on semiconductors; Today it controls the potentially more advanced artificial intelligence system in the world, Deepsek.

The United States also accelerated at the same time, to keep China at a distance.

We, on the other hand, decelerate both ever and, even more, in comparison with all important economies. One would expect the premier and the ministers of the economy or companies they lose sleep in the face of such a problem, Because in this way the foundations of other poor working decades are being laid, new emigration and further demographic erosion of Italy.

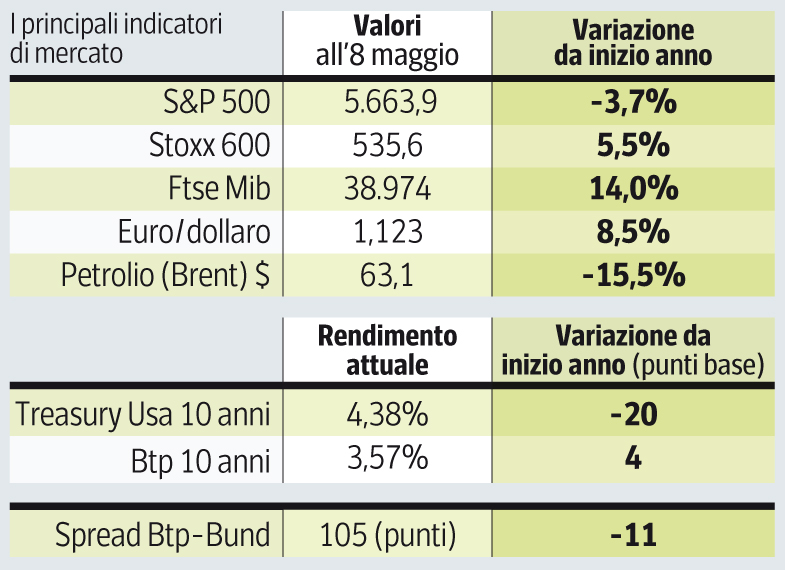

The government seems more busy to intervene directly in Power matches of the financial system. As for the rest, it is satisfied to be able to keep public finances relatively in order: in 2024 the deficit dropped to 3.4% of GDP from 7.2% of the year before, a certainly remarkable and precious result. All in all, the debt is under control. Yes, but how are we succeeding? And why are we succeeding in spite of a tax cut on the 17.6 billion paycheck in the latest budget maneuvers? There is really some taxes that has no smell, flavor, or color – an invisible tax – but that you pay the same?

What does not square

To get a hypothesis on what is going on, we must keep in mind some quantities concerning developments in the country between 2021 and 2024.

The first is certainly positive because it concerns The number of employeeswhich in the last four years has grown by 9.2% (Today in Italy over 24 million people live who have a job, a record).

The second size concerns theThe total volume expressed in euros of the gross-paga bags of employee work, which grew by 11.5% (from 738 billion euros in 2021 up to 823 billion euros in 2024, according to Istat).

The third greatness is then inflationthat is, the average increase in the cost of living accumulated in the last four years, of 17.6% (according to the most common ISTAT index).

The fourth greatness is instead the increase in the revenue of the income tax of natural persons, Irpefwhich is 18.85% (from 198 billion euros in 2021 to 235.5 billion euros in 2024, according to the Finance Department)

At a glance, in this sequence something does not come back. For example, it should be clarified because the total of gross-paga envelopes in Italy grows only by 11.5%, even if the adjustments of the contracts to inflation are already worth about 10% and this should be added another 9.2% more employed than four years ago. In essence it must be clarified because the volume of wages and salaries expressed in quantities of euros is growing half of how much one would expect. Probably because the people who retire had much more profitable contracts than the new hires; Therefore, the average cost per employee in Italy tends to go down in real terms. Well -paid people come out, people enter badly paid. We are in full wage deflation, in full poor work. Thus in the last four years the total mountain of the -patches in Italy is backward – has lost 6.1% – in proportion to the cost of living despite over two million more employees.

But why do we pay more personal income tax? The hidden weight of the taxes

But then there is the other point that, intuitively, does not square. If the Monte-Pago Mount calculated in euros has risen by 11.5% from 2021 e Has the government even cut the income tax on lowest income, why then the revenue of the IRPEF even increased more than the mountain of the-patches? I remember the number, the latter increased by the 18.85% That is, it has had an almost double growth rhythm compared to the total-paga bags.

The invisible tax: the « Fiscal Drag »

This is the strangeness that is explained with the invisible tax. Is the so -called « Fiscal Drag »the « fiscal drag » determined by the adjustments of wages to inflation. The rates on the basis of which Irpef is calculated in Italy in fact do not go hand in hand with inflation or with the average adjustments of the employment contracts. Those remain, notoriously, always fixed: the brackets are 23% up to 28 thousand euros of income, 35% from 28 thousand to 50 thousand and 43% over 50 thousand. But during these four years the adjustment of the-patches to the cost of living -however partial, very partial-has pushed several tens of billions of euros, perhaps up to about one hundred billion euros especially of medium-low income, beyond the thresholds and inside the Superior Irpef Scaglioni.

Furthermore, for the same phenomenon millions of families have lost automatic deductionswhich decrease in growing income expressed in quantities of euros. But in fact The growth of income is only apparent, because in the meantime, inflation has eaten much more than the contract increases. While the growth of the Irpef withdrawal, well, that is real: in essence less income, on the other hand taxed more.

It should be emphasized that this phenomenon affects above all the part of the low classes that loses the deductions expected up to 15 thousand euros and above all the average classes that exceed the thresholds of the various brackets, while those who are already well above 50 thousand euros travel mostly sheltered from the « invisible tax ». Therefore on the one hand The families of the Middle-Basso class have paid more Irpef, on the other they saw reduce the purchasing power of their-patterns before taxes.

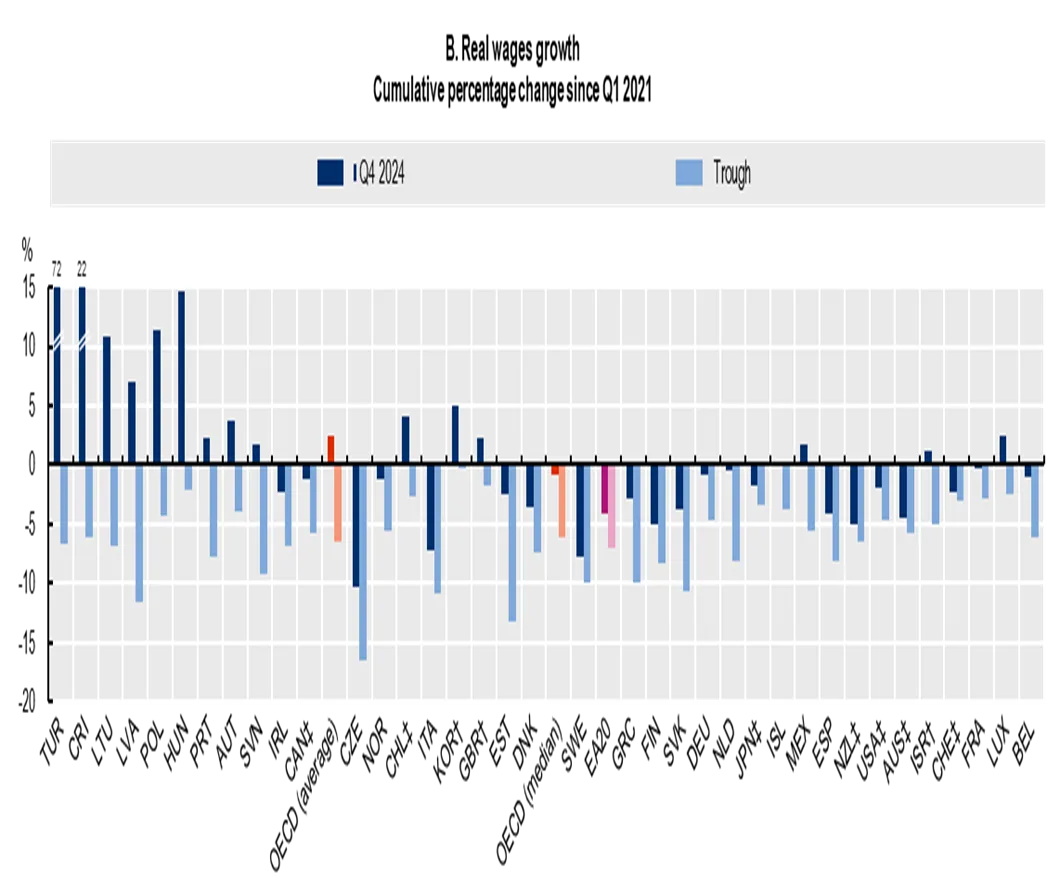

Where we are in the OECD

The graph above, based on courier estimates on the latest OECD data, shows that The loss of purchasing power in Italy since 2021 for the non -full adaptation of contracts to the cost of living is 7.2%: the largest third of the 37 countries of this club.

How much is the Fiscal Drag for Italian families

One point remains to be specified: how much is the « invisible tax » apply, how high is the withdrawal from Fiscal Drag? If the IRPEF revenue in 2024 is 235 billion and rose by 7.35% faster than Mount Bust-Paga, the difference in fees paid more is 17.2 billion only for last year. An « invisible » tax that is worth almost 1% of GDP.

I know that my esteem is raw and that it is not only the employee work that pays the Irpef, but it coincides with the calculations Much more correct than the economists Marco Leonardi and colleagues. Now, this amount of taxes is more or less equal to what the government underlines that it has removed from the lowest income thanks to the cutting of the wedge; But in the meantime, to compensate, he had also canceled various deductions on contracts. So it is not true that the government has reduced tax taxes: overall it raised them, especially for the middle classes. In fact in the Public finance document 2025 just published, the strong increase in direct taxes and the total revenue in 2024 in proportion to GDP; while « Taxing Wages 2025 » of the OECD show That Italy last year had far the strongest increase in the tax wedge among the 37 countries and we went back to the fourth position for higher withdrawals on the paychecks. And the work, due to the low investment in research, development and knowledge, is impoverished with its own.

Only an incredibly out of focus opposition compared to the real situation of the country could not notice it and not to say anything.

The Italian flat tax

Meanwhile, about five million taxpayers, often equipped with good assets, are sheltered from the « invisible » tax Because they pay much lower and above all higher rates flat: from dry coupons on rentals, to theone flat taxto the re -evaluations of unlisted companies, to capital income, to « dominical incomes » in agriculture, to prehistoric coches and could be continued.

The middle class who pays taxes (and the rich who do not pay them)

As In Italy the average class of employee work pays more and more rates by RiccchI, while at least Some rich pay rates more similar to those from poor.

I know it sounds populist. You can agree or not, someone may even carry out respectable assessments to argue that there is an economic logic. But these are the facts. And the Italian Constitutionin article 53, says that « everyone contributes to public expenses due to their contributory capacity ». It has not yet been amended.