Business banks, funds and consultants: because now American finance risks losing the world record

Europe sells more goods in the USA than it purchases, but US finance dominates in the old continent. A primacy that Trump’s protectionism puts at risk

« European countries are cheating on us in the trade: they do not take our agricultural products, our cars and nothing else, while we buy millions of BMW, Mercedes, Volkswagen machines ». According to Donald Trump, the European Union was born to « fuck » the United States. A thesis repeated indefinitely by the American president: but does it hold up to the proof of the facts?

The balance of services

If you keep accounts only exchanges of « tangible » goods, it is true that the European Union sells in the USA more than they buy: in 2024 the EU countries exported assets for 531.6 billion in America and imported them for 333.4 billion, with a positive balance of about 198 billion. If, however, it widens its gaze to the services, the scale is rebalanced because in the field of finance, technology and intellectual property it is American companies that are the master in Europe: their exports are worth 427.3 billion, while for the service companies of the Old Continent, the overseas market is worth only 318.7 billion, with a balance of 108.6 billion in favor of the USA.

The dominance of the US finance

These numbers offer ideas to understand in which sectors the countries of the European Union could threaten retaliation against the United States to sit at the table with Trump in a stronger negotiating position. The technological services of web giants such as Netflix, Amazon and Meta are the first suspects, But any countermeasures on cloud, streaming and artificial intelligence also involve risks for the EU which, at the moment, is very dependent on the USA for the supply of these systems essential for industry and consumers. The financial sector, on the other hand, probably offers a more favorable « clash » because Europe has a competitive domestic offer of banks, savings management companies, groups of payments and capitalAlthough in recent years it has become the territory of conquest for stars and stripes giants.

Investment Banking

Let’s take the case of the services of Investment Bankingie of the advice that institutions offer companies that must collect money for investments, acquisitions and other extraordinary operations. Until the beginning of the last decade, the European and US banks were divided by the rich commissions of this activity which is worth about 70 billion per year. NEL 2013, calculates S&P, US institutes had a 55% share in the global market, Europeans 45%. Then, thanks to the sovereign debt crisis, American banks took over enough to arrive in 2024 to forfeit 70% of sector revenues, leaving only 30% to European competitors. Last year, Dealogic estimates, Stars and stripes business banks have occupied four of the first five places in the consultancy ranking for European companies in merger and acquisition operations. A predominance firm for years in the Old Continent who, however, will be put to the test by the Trump test.

Dimon alarm

Some fear begins already emerging among the lords of Wall Street. « America First is fine, » Jamie Dimon, number of JPMorgan, the first US bank, said a few weeks ago. « If, however, it becomes America Alone because we tear the world to pieces by clashing with Europe and China, then we will have made a mistake. » In the coming months, in fact, the Old Continent will probably have a great need for investment banking services: governments to issue debt to finance defense and infrastructure expenses, companies to support these investment priorities and take advantage of the greater availability of Brussels to support industrial aggregations to create European champions. Without the need to resort to explicit measures, A possible reduction of US banks consultancy mandates for these operations would inflict no damage to American financewhile giving a push to European institutes.

Visa, Mastercard and the digital euro

Another financial service exposed to the risk of commercial escalation is that of payments, today dominated by US groups. According to the estimates of the central bank, Two thirds of electronic transactions with paper in Europe are intermediated by international payment circuits, i.e. by the two US giants Visa and Mastercard And, to a lesser extent, by American Express. This supremacy poses not only competition problems and increased commissions for merchants – supported Piero Cipollone, executive member of the ECB board. However, it also makes the infrastructure of payments and the most vulnerable European financial system to external influences. The ECB therefore intends to accelerate on the digital euro project; In the meantime, however, EU governments could encourage The use of national payment schemes such as ATM in Italy or CB in France.

Savings management

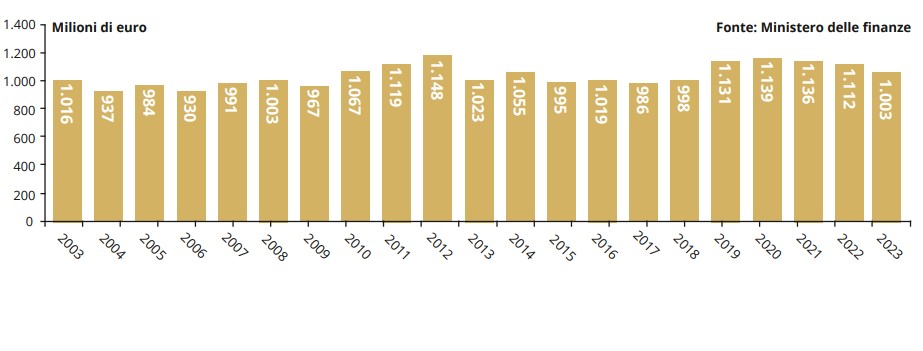

One last front for any retaliation is that of savings. Also in this area, US finance has conquered a lot of land in Europe in recent years. According to the data of ISS Market Intelligence, The European savings managed by American companies are more than doubled in a decade, going from 2100 billion in 2014 to 4500 billion in September 2024. Merit above all of the advance of passive, Etf and indexed funds, which collected money in quantities from individual and institutional investors with the offer of low -commission products. Giants like Blackrock and Vanguard have thus subtracted market shares from European asset managers, also winning rich management mandates by social security cassi and pension funds from large companies. Assignments that, again, a possible increase in commercial tensions between Washington and Brussels could put at risk of renewal or termination.

The deductions of capital from the EU to the USA

This offensive of the American managers in Europe also had a passage of capital between the two banks of the Atlantic. According to Mario Draghi, 300 billion of European savings every year are invested abroad, first of all in America, due to lack of domestic use opportunities. The situation could change in the coming months, subtracting petrol from the Wall Street engine and, therefore, from the growth of the US asset managers.

Manufacture and Finance

In an attempt to make America again great, in short, Trump could cause a reduction in stars and stripes finance. In the last fifty years, it is true, the incidence of the manufacture in the total jobs in the USA has halved in the street not only of production progress, but also of the massive relocations in countries with low -cost labor implemented by American multinationals (who appear on closer inspection the first recipient of the world duties of the US President). However, deindustrialisation has been accompanied by a financialisation of the American economy that led banks, managers and US payments to dominate the global market and has allowed the country to attract capital in quantity to finance the rise of its technological giants.

Main Street and Wall Street

Trump’s duties risk putting this model in crisis. The real economy could benefit from it in the medium-long term, if commercial barriers really manage to bring productions in the United States, reversing the flows of globalization. Finance, meanwhile, is already suffering, inaneing a negative bag session after the other. Wall Street supported him with millions of donations in the election campaign, Main Street gave him millions of votes: who will choose Trump?