Blind reform? Farmers are frightened by the expected taxes

Will seek justice

Mindaugas Maciulevičius, chairman of the Kaunas District Farmers’ Union, does not hide: they are looking for allies to convince the government that farmers are being prepared to do wrong and unfairly.

« We are talking about planned tax innovations. We want to emphasize that farmers do not look for land, how to avoid taxes, but are trying to show that the changes must be based on justice and solidarity, » Maciulevičius emphasized Kaunas Day.

He pointed out that government decisions could be as unpredictable and harmful as weather abnormalities.

« We want to work without any turbulence. Sometimes nature gives us good opportunities and then we can enjoy the harvest. But it is a shame and wrong when the turbulence is raised by our power, » said M. Maciulevičius, adding that it expresses the position and opinion of the Kaunas district farmers’ community.

Tax trap

Farmers are most puzzled by the planned changes in income tax.

« The attitude that more profit will have to pay a higher fee, the business of farmers cannot even be logically applied. It is like an attempt to put shoes on a completely different size leg, » he said.

In support of this statement, he talked about the decisive results of the work of farmers.

« Sometimes you get a fertile period and get more profit. Then you have to pay a higher profit tax percentage. But maybe last year there was no profit at all, maybe you sit in the minus. The year was good, the third is the average.

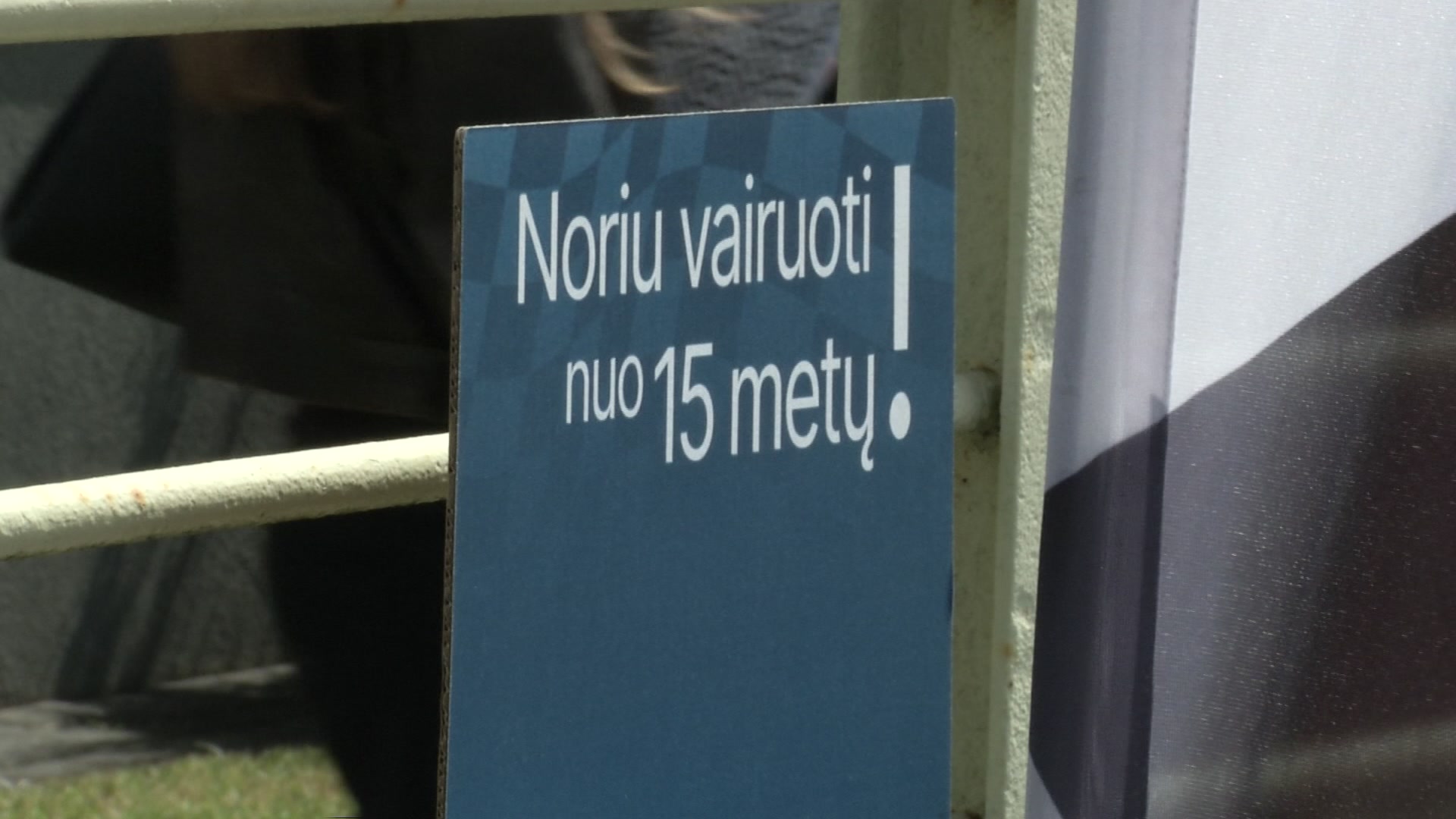

Anxiety: Farmers ironize that government decisions can be as unpredictable and harmful as weather abnormalities. / Photo by Regimantas Zakšensk

Wants stability

He regretted that the planned tax changes seem to be invisible to constantly ongoing dramatic changes in climate, especially the dynamically changing markets.

« It is very disappointing when we see the efforts not to create stability, but to cause more destruction. The real devil. New tax ideas are in danger of such consequences, » says the farmers’ leader.

According to him, at least taxes should be stable when working in a maximum dynamic environment.

« We farmers need to be inventive, advanced, mobile and, as EU legislation obliges, to adapt to climate change. Every day there is a risk to our crops. Such a daily routine. For example, now that hail has passed, Ledish in Kaunas district has cut 150 ha. Although you can find yourself in an absolute minus and go bankrupt, ”said the chairman of the Kaunas District Farmers’ Union.

It is a shame and wrong when the turbulence is caused by our authorities.

It is harder to adapt

Maciulevičius pointed out unpredictable market changes, which are increasingly difficult to predict and adapt to them at least.

“When the war began, fertilizer prices to space rose, the purchase prices rose slightly, fell a little, and a lot of farmers finished that year in the minus.

Similarly, with milk purchase prices – it falls, it rises. These are just a few examples. All the instability that the planned taxes will be exacerbated are most painful not for the smallest or largest farmers, but for the most important – medium -sized farms. They form the basis of Lithuanian agriculture. We want them to be viable, but now they are the most abused, ”Maciulevičius lamented.

Insights: M. Maciulevicius regretted that the planned tax changes seem to be invisible to the ever -occurring dramatic changes in climate, especially the dynamically changing markets. / Photo by Regimantas Zakšensk

Sees contradictions

The leader of Kaunas district farmers emphasizes the lack of logic in the idea of taxing insurance premiums.

« By encouraging that as many crops as possible, the state is covered by the policy with the money of taxpayers. Therefore, now it seems illogical to charge additional insurance, » Maciulevich wondered.

He pointed out the gaps on the taxation of individual activities for farmers.

« It must be understood and taken into account that farmers’ individual activities include several or even a dozen activities – notary, entrepreneur, lawyers and more, » he said.

Opportunities to manipulate?

Kaunas district farmers are also concerned with the newly modeled land tax, which will be determined by the determination of land value. Land values in Kaunas district are high, and this can make it even more difficult for farmers in the district.

The operation of the technique is constantly becoming more expensive. This trend will remain in the future.

« The excise duty is constantly increased, the process has not stopped for many years and, as we can see from the plans, the technical registration fee has increased, the technical inspection fee is also being considered. Taxes are VAT, PSD and so on.

He ironized that with such tax pressure, it would be more beneficial for farmers to take manipulations to establish private limited liability companies or cooperatives, and then pay much less than profitable dividends.

« That is why we are considering that if the plans are not responsible and the tax changes will go to the mistake of being offered, we will be forced to end with individual activities and reorganize private limited companies or cooperatives, » Maciulevičius told Kaunas Day.