Banking. 5 largest profit 13.3 million per day

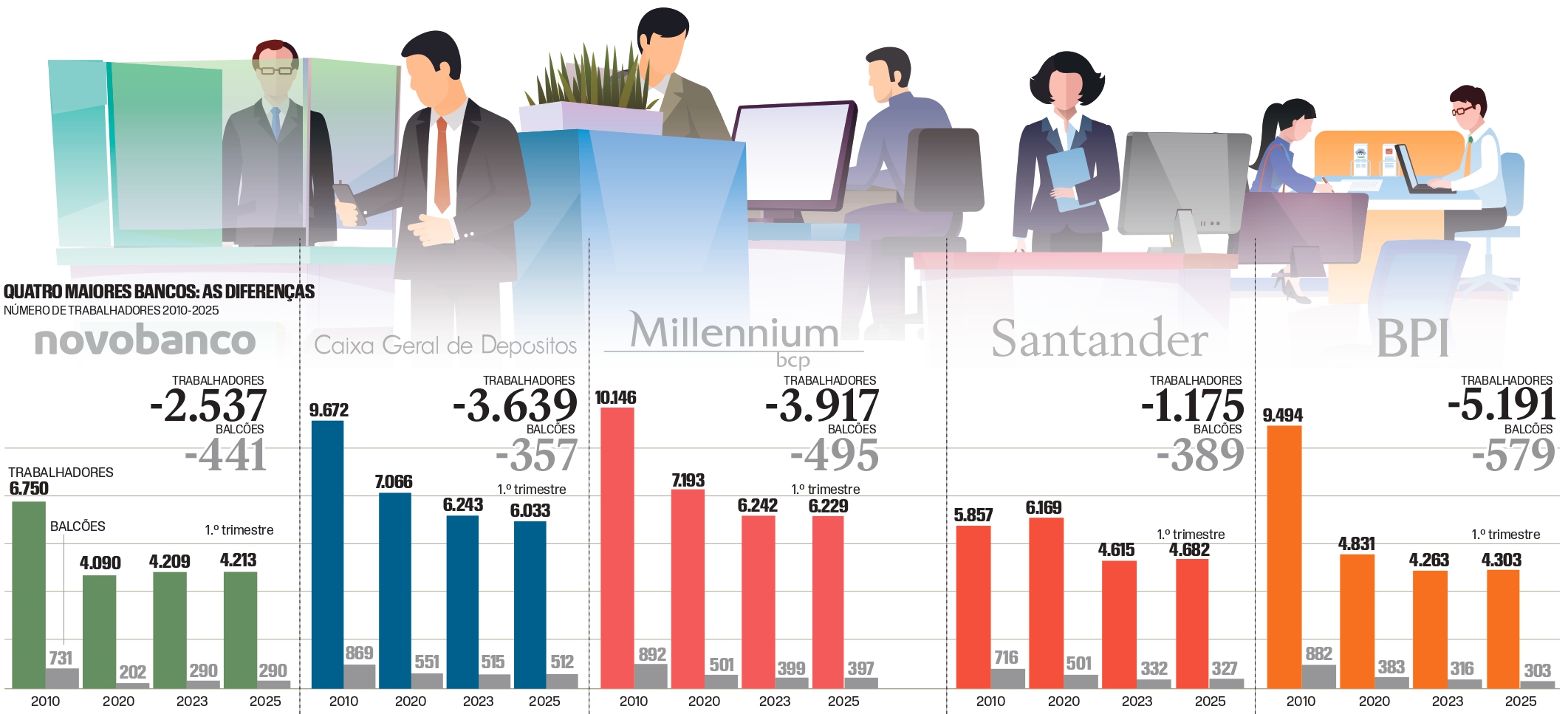

The five largest banks to operate in the national market – Caixa Geral de Depósitos, BCP, Santander Totta, Novobanco and BPI – profited 1,219.5 million euros in the first three months of the year, which gives an average of 13.3 million profit per day. A result that was slightly below the same period last year, at which time they had profits of 1,251.5 million euros, influenced in part by the fall of interest rates. Increased commissions and smaller structures – both counters and workers – continue to influence results (see infographics).

At the sunrise, the president of the National Union of Quadros and Bank Technicians (SNQTB) has admitted that « from the point of view of citizenship it is good to have companies that are well » and in relation to the reduction in the number of workers acknowledges that they will have reached the end « restructures, at least, violently ».

Cash profits 2 million less

Caixa Geral de Depósitos had a net result of 393 million euros in the first three of the year, a drop of 2 million compared to the same period of 2024. Domestic activity contributed 358 million euros to the consolidated result, while international activity was responsible for 34.5 million euros, and was negatively impacted by the reinforcement of provisions and imparities of the Mozambique, which caused a break of 12.9 million. euros in its contribution to the net result of the cashier group ».

Still, Paulo Macedo, chairman of Caixa’s executive committee, believes that the perspective is growth and is said to be excited about the results.

The financial margin (difference between interest charged in credits and interest paid in the deposits) consolidated recorded a decrease of 80 million (-11.2%), reaching 636.2 million euros.

The commissions rose to 147 million, although Caixa did not update the Poree for the third year, but it was the reversal of provisions and imparities to the risk of credit to contribute to the stabilization of the final result, with a contribution of 53 million.

Structure costs rose to 308 million, plus 3.3% compared to the same period last year. The turnover increased by 6% to 167 billion euros, of which more than 76 billion correspond to client deposits, representing a 23% market share. And the loan portfolio rose 2.7% to 48.9 billion with loans to buy home to increase 2% (in line with the market) to 25.95 billion euros.

In the first three months, deliveries to the state reached 244 million euros. The amount includes 15 million regulatory costs, 176 million in taxes and 34 million in specific bank contributions. And foreseen an IRC payment in 2025 in the order of 700 million euros.

BCP Result

The BCP registered a profit of 243.5 million euros in the first quarter, an increase of 3.9% compared to the same period of 2024. Only the net result of the activity in Portugal set out at 218.9 million euros, corresponding to an increase of 7.6% compared to the same year’s same year. It is, according to the CEO of the financial institution, of a ‘quite reasonable’ net result, taking into account the « very difficult geopolitical situation ».

The financial margin of the financial institution led by Miguel Maya rose 3.6% to 721.1 million euros, while the commissions increased by 2.1% to 201.4 million.

The BCP exceeded 100 billion euros from customer resources, registering a growth of 6%, including deposits (85.1 billion) and out -of -balanced resources (18 billion). The credit portfolio rose 2.2% at the group level, and in Portugal it grew 1.3% to 38.9 billion.

Operating costs fired more than 10% to 339.7 million euros, influenced mainly by the increase in personnel expenses, which went from 165.7 million in March last year to 188.1 million in the same month of 2025.

Santander profits less

At the end of the first quarter, Santander Totta registered a net result of 268.8 million euros, a decrease of 8.7% compared to the 294.4 million registered in the same period.

Between January and March, the financial margin fell 19.6% to 354.2 million euros, at a time of gradual interest reduction following the fall in interest rates of the European Central Bank (ECB).

Total Customer Credit (Gross), in the amount of 50.7 billion euros, registered a homologous growth of 8.7%, « supported in the high origin of new housing and companies, » said the financial institution led by Pedro Castro and Almeida

Customer resources rose to 46.3 billion euros (another 6.9%compared to the end of March 2024), with growth in both customer deposits (+6.7%) and out -of -balanced resources (+14.8%).

Liquid committees remained virtually stable, ranging only 0.6% to 121.7 million euros. The costs were 130.3 million euros in the first quarter, 1% more than in homologous terms. Within these, personnel expenses grew 3.2% to 72.5 million euros.

Novobanco also falling

Novobanco registered profits of 177.2 million euros in the first quarter, 1.9% less compared to the same period. « The results of the first trimester of 2025 are in line with our expectations and confirm the strength and resilience of our business model, » said Mark Bourke.

The financial margin descended 6.7% to 279.1 million, while the commissions increased 12.3% to 84.3 million euros.

The commercial banking product fell 2.8%, setting at 363.4 million euros (a decrease of 10.6 million). The total banking product, which includes the results of financial operations and other exploration results, grew 0.4%to 373.2 million.

Credit to companies rose 5%to 16.4 billion, while credit to private individuals grew by 24.6%, reaching 1.9 billion and loans for housing purchase increased by 3.1%, exceeding ten billion euros.

Operating costs settled at 125.2 million euros. Personnel spending was 68.4 million, 1.2% above last year.

BPI with 137 million

The BPI obtained a net result of 137 million in the first quarter, a 13% increase compared to the 121 million recorded in the same period of the previous year. The activity in Portugal contributed 98 million euros, a decrease of 13%.

« The results of this quarter confirm the strong dynamism of BPI’s commercial activity, reflected in the 7% growth in savings capture and the 5% increase in credit granting, with emphasis on housing credit, where we registered almost 1 billion euros in new operations in the quarter, » said João Pedro Oliveira and Costa, CEO of the bank.

The financial margin was decreased from 9% to 223 million euros, although the credit volume risen to 31.5 million euros.

The bank product fell 8% to 292 million euros, with the commissions to give another 2% to 75 million, which eventually mitigated the breakdown of the margin. Already the bank committees rose 2% to 75 million, while the costs of the financial institution remained practically stable by growing 1% to 126 million euros.

Regarding the credit granted, there was an increase of 5%from 30.1 billion euros to 31.5 billion euros, with particular highlighting the credit granted to companies (plus 4%) to 12 billion, and in housing credit, from 8%to 15.7 billion euros.

Credits with public warranty are adding

In the first quarter, housing contracts using public warranty – a measure for young people up to 35 years – accounted for 9% of the total number of new contracts and 13% of the amount of new contracts. According to data from Banco de Portugal (BDP), the average amount of loans hired by borrowers who resorted to the warranty was 190,000 euros, compared to 173,000 in credits contracted by eligible borrowers but did not resort to warranty.

Among the most prominent regions are the Metropolitan areas of Lisbon and Porto, namely the municipalities of Sintra, Vila Nova de Gaia and Seixal.

Santander Totta has already said that by the end of the three months of the year, more than 1,300 contracts with young people have been made and that the total value of these loans ascends to more than 250 million euros.

Also the BPI revealed that, by the end of April, there were 4,760 requests for public housing credit and loans were granted total of 240 million euros. « The percentage of approval and rejection is similar to other housing credit products in the bank and usually low, » explained João Pedro Oliveira and Costa.

The BCP received 5,700 requests from clients equivalent to 1.1 billion euros, and operations were approved in the amount of 280 million euros. Miguel Maya said he was convinced that the use of the warranty by banks to be reimbursed from the credit « will be very low and that customers will pay their credits normally ».

For its part, Caixa received 6,800 requests for home purchase with state warranty in the total amount of 1,300 million euros. Of these, 2,800 credits totaling 530 million euros have been hired.

With an eye on the novobanco

The presentation of bank results coincides with the process of selling the novobanco. And after the Finance Minister revealed that « it is in the interest of the country that there is no excessive concentration of the banking sector of a single country, such as Spain », also Paulo Macedo revealed that « it is not healthy for Portugal to have 50% of the Spanish bank ».

As for the possibility of the public bank being able to enter the race, the CEO explained that he can only have a part of the business for competition reasons. « If there are other alternatives (being with the whole bank) we will see them », saying that « the separation (from the novobanco) would be very complex. »

Already the president of BCP again admitted that the purchase of the financial institution would only be interesting if it brought value to the bank and that at this time does not have that confidence, namely due to the price. «We are not concerned who buy or not buy, whether bank A or Bank B is larger, that is not our theme. Our theme is to compete for deserving customers’ confidence and creating value for society and shareholders, ”he said.

Also Santander Totta has already ruled out this possibility of purchase. « It is not in our radar to make acquisitions, » admitted Pedro Castro Almeida considering « strange » that Caixa Geral de Depósitos may have the fourth largest bank in Portugal and a third of market share, but believes in competition authorities to evaluate the operation.

Contrary opinion will have the owner of BPI. According to the Spanish press, CaixaBank has hired Morgan Stanley as an advisor to evaluate a possible acquisition of Novobanco and will have to decide whether they advance to a purchase that would allow him to have a dimension of 90 billion euros in assets.

:format(webp)/https://content.production.cdn.art19.com/images/f8/ad/c9/d6/f8adc9d6-62c4-4869-a14e-a719a04078c8/d7f10d64e734cb039d2cc5926f0f5a2affb29e89ce45aa7ce04d7421135eeb3f3f40ba1857ba0bda38fc748ccc7e4ea70c7b3aa906465e60f4470fc62eded854.jpeg)