Bags, Frankfurt and technological actions: here’s who has the most rebound chances between global lists

Based on current assessments and profit estimates, the potential for the recovery of the various markets can be calculated. Europe with fewer sprints, but Germany is an exception

What direction will the markets take after the violent fall and the partial recovery? Trump’s ballet on the duties, unknown and unpredictable, his impact on inflation and on the trend of the economic cycle, the uncomfortable position of the Federal Reserve – narrow between the risk of a recession and the uncertain dynamic on consumer prices – make the answer very complicated. However, there can be a reasoning on which areas of the market have greater recovery chance, when the price lists come out of the quagmire of an uncertainty that has now reached anomalous levels. It is not enough to focus on the bags that came more from February 19, the maximum peak reached by Wall Street. On balance, from that moment, the investors of the euro area who had not protected from the exchange risk have lost between 0.7% of the German shares and 20% and beyond American technological securities, led by the magnificent 7: Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, Tesla. Here you need a clarification: the prices of the Nasdaq fell just over 10% from the February record, but the depreciation of the green ticket aggravated the losses of those who invest in euros.

The unknown of the dollar

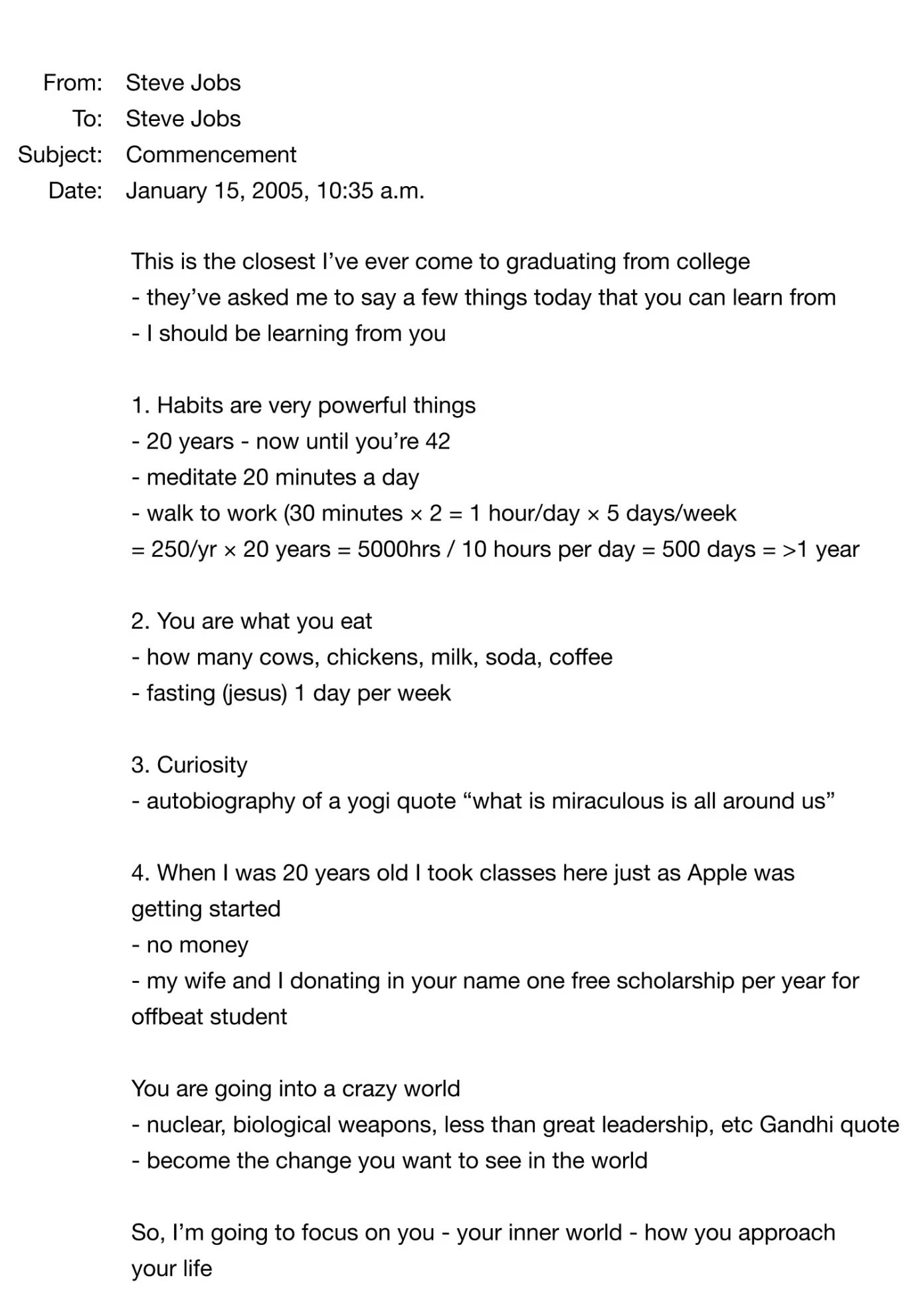

The dollar, moreover, could give up another 5 or 6 percentage points in the next 12 months, according to Goldman Sachs. So how to identify the best positioned actions for the future recovery? Gamma Capital Markets analysts have developed a synthetic indicator to understand which indices have the greatest potential. The technology, both the American and the Chinese Tech samples listed in America, represented by the Golden Dragon China index, offer the prospect of Rialzo Maggiore, followed by the Dax, the US Stock Exchange and the global actions. In the queue, the index of European actions. The indicator compares the current assessments with those of the end of 2024, when the markets were at the top, and incorporates the expectations of investors on the growth of profits in the next 12, 24 and 36 months, giving greater relevance, because they are more reliable, to estimates to one year. « In this way – explains Carlo De Luca, manager of the Capital Markets range asset management – we measure which indices are normalizing at the rhythm sustained, returning to more contained evaluations ». Those who, therefore, could be interpreted as an investment opportunity. « Attention – says De Luca – having a high score does not necessarily mean that that market should be inserted in the wallets today, but simply that an opportunity opens in evaluative terms. In fact, the market phases act as a discriminant: while in the economic expansion cycles, the indices to be favored are those with higher value, in contexts such as the current one – in which a correction is still in place – the growth titles, with higher growth, are penalized. The rotation in place outside America towards cheaper titles could continue in the coming months: on the one hand, because many American companies, in particular the magnificent 7, still have very high evaluations. On the other, because the climate of uncertainty, between commercial war, stagflation and lack of stimuli by the Federal Reserve, continues to weigh ».

The Dax index

Europe as a whole boasts more content multiples. Yet it has too low growth prospects: with the minimum value, one, the synthetic indicator suggests a very weak potential for recovery from current levels. An interesting compromise can instead be represented by the Frankfurt Stock Exchange, which has reasonable evaluations and promising growth prospects, after the turning point on public spending, in an expansive key, announced by Friedrich Merz, the new German chancellor. « It is not the time to focus on the big names of American technology, which have yet to absorb part of the correction, » notes De Luca. According to the expert, the bags could return to test the minimums reached in early March, especially if the economic framework should deteriorate and the Federal Reserve delayed to normalize its monetary policy. «The American central bank wants to see us clearly. At a certain point, however, he will be forced to intervene, especially if the ascent of returns on the titles of the American treasure will begin to represent a potential systemic risk ».

Gold and liquidity

« In Europe – the manager says – we prefer the Dax index and sectors such as construction materials, telecommunications, automotive, travel & leisure and basic resources, while in the US we like banks, biotechs and health, which have more reasonable evaluations. We also maintain an exposure to Chinese technology that combines multiple bass with good growth prospects: there is room for a further convergence of the assessments between US and Chinese tech. We also remain exposed to physical golden golden gold, to defend ourselves from the fluctuations of the dollar. Above all, we recommend maintaining a liquidity bearing to use when the assessments are further designed « .