At key moments, Trump always stepped back

In the first hundred days of reign he is the president Donald Trump felt a familiar thought on your own skin Ayn Rand, who says you can ignore reality, but you cannot ignore the consequences of ignoring reality. President Trump is probably a world record holder of neglect of reality, but from the perspective of financial markets we can find that from the beginning of April, when he « took a joke », he always took a step back at key moments and relented under the unknown consequences of his own reckless acts.

Interestingly, sale in stock markets was not the one that softened stubborn Trump, but it was an unexpectedly determined slap of bond and foreign exchange markets, when the 10 -year bonds flew into the sky earlier month, while at the same time the foreign exchange markets began to fall heavily a dollar course. Without exaggeration, we can say that the dollar and state bonds are by far the most important US original articles and the central symbols of US financial and economic power and domination. As a financial analyst, I felt relief because the bond markets showed that they could intimidate even the biggest abuser, President of Trump.

For participants in the financial markets, there is good news that Trump has relented or relented. softened in three key moments. For the first time, with the announcement of the 90-day moratorium on the introduction of the inspirelessly high customs duties, the second time on the willingness to conclude a trade agreement with China and the third time with the cessation of grave attacks or. ideas to dismiss the President of the US Central Bank.

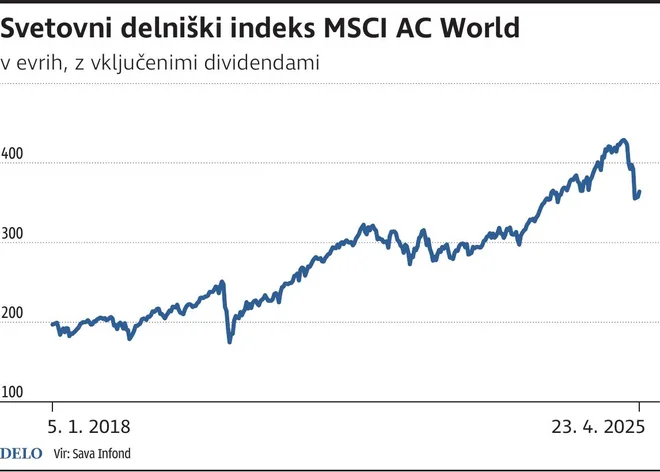

Indexmsciacworld Photo GM IgD

As participants in the markets, therefore, we can be at least somewhat reassured by the realization that Trump is not the omnipotent king of the world and that financial markets have mechanisms that can to some extent limit and neutralize the negative consequences of his ignoring reality.

The world’s most important stock market indices are moving in the moderate correction area of about 15 percent below the highest values these days, which in fact shows how hard it is and resistant to the stock markets for external shocks. It would be interesting to see what falls in the stock markets would theoretically calculate Finance professors and strategists on Wall Street if they were presented with a case study in which the US president will trigger a trade war of historical dimensions in the last century, and at the same time they will start falling steeply in the chaotic macroeconomic environment?

It is by far the most important for the economy and markets to calm the passions of Trump’s customs duties as soon as possible and to crystallize the framework of future trade and their effects. I hope that this will happen as soon as possible, because in the US every day, the influence of customs wars and extreme uncertainty on the real economy is more evident. For example, there are already disorders of the transhipment and logistics of goods, which make some traders already warn that it may soon start running out of goods and that a similar shock to the side of the offer is approaching as in times of coronavirus eruption.

Damjan Kovačič Photo Boštjan Lah

A similar opinion is a member of the Governors Committee Christian Wallerwho says that « in all this uncertainty, it is impossible to predict how the economy will develop far into the future. » In his speech, he touched two scenarios that assume the rise of customs dates to 25 percent (negative scenario) or. agreement on ten percent general customs duties (starting scenario). According to him, in the case of a starting scenario, customs duties would still affect economic activity, but growth would remain solid. In an environment with low unemployment and declining inflation, reducing interest rates would be good news and an opportunity to sustainly recover financial markets.

It is hard to imagine what stress are experiencing companies that have not been guilty or obliged in the first battle lines. Imagine finding yourself in an unknown space where the furniture is all the time. Until the consultation of the light, it is probably best for most of the most exposed actors to stay alone.