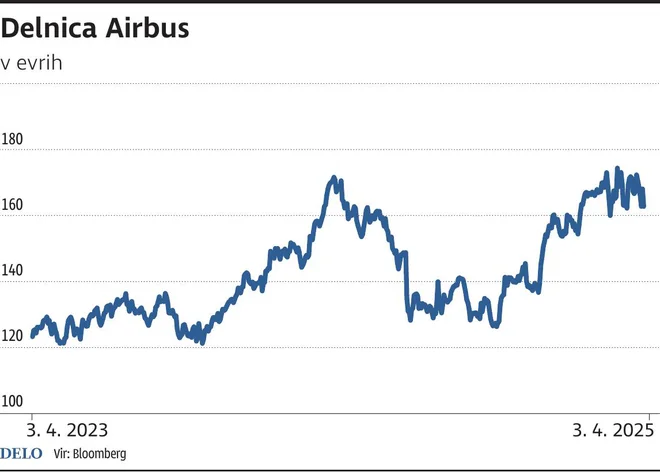

Airbus in the most expensive aircraft segment has no competition

Airbus is one of the largest aviation and defense companies. Their pronounced competitive advantage is based on the costs of the transition of clients to another provider, patents and licenses. In a commercial aircraft segment, they have a Boeing duopol. Both are gaining a share in a rather besieged medium -length market market. Interestingly, customers remain with them, despite the fact that their segment of defense and universe had a significant expense of costs in the development of the A400M transport aircraft. But there are really few alternative providers, and the cost of switching to another provider is high. It is cheaper for the defense program to stay cheaper, as there are few suitable alternatives. A similar story is with their helicopters, who also have pronounced competitive benefits. They are characterized by having an extremely profitable after -sales service business.

The entry obstacles are high

The commercial aircraft production segment has high obstacles to enter new competitors. Production is technically demanding and the regulation is extensive. Both Airbus and Boeing are benefited from the entry barriers as they operate in Duopolo on the global large passenger aircraft market. Most new orders in the air market will be shown in the growth of the revenue of both key manufacturers. Very likely, the demand of aviation companies for their products will remain high enough and permanent enough to create relatively high returns on invested capital in the long run. The adjusted return on the Airbus invested capital is 27 percent and the Boins is 21 and the other competition is 18.8 percent.

Airbus Photo TT IGD

The market, characterized by lack of alternative aircraft suppliers, are extremely important for customers. Very long production cycles are considered to be an argument for high transition costs. The long life of aircraft, the economics of their operations and the fact that there are only two global suppliers, is an environment in which long -term competition between Boeing and Airbus takes place. Currently, Boeing offers top quality products in the wide -angle or long -leaf aircraft category, and Airbus enjoys a long -range narrow -range category, also known as the Segment of the Central Square.

Grbic Aleš, Investment Manager KBM Infond, 23.1.2017, Maribor (author: Regent Tadej) Photo Tadej Regent/work Regent Tadej

The Airbus segment of commercial aircraft includes agile narrow airplanes that are ideal for effective short flights, as well as large, wide -angle, which are commonly used for long or long or. intercontinental flights. Recently, orders have increased significantly due to the global rise of low -cost carriers and improved technology. This allows smaller aircraft to carry out air routes that were previously premature. In addition, domestic flights after the pandemic have recovered much faster than international. Therefore, airline companies prefer to order smaller planes instead of larger ones. The key is that Airbus has no competition in the most expensive segment. The A321XLR offers a much greater reach than the planned Boeing 737 MAX10, which may not be ready for use before the end of 2025. In the wide -tradition aircraft segment, the expected growth is significantly lower, as newer narrow -level replacement will replace wide -angle. Current orders show that the market prefers Boeinga 777, 777x and 787 than the Airbus A350.

Also present in defense

Airbus also has a defense segment, but it only gives a good ten percent of the total business profit. This segment will have above -average growth over the next ten years, as the EU has adapted the legislation that allows countries to higher defense expenditures and loosen the rules of fiscal sustainability.