Acquiring raw materials in the name of durability

Raw materials have been the foundation of a value chain for millennia, including in our industrialized world. However, due to the increasing number of the world’s population and increasing expectations regarding the standard of living, energy transition and increase in durability are necessary, which directly affects the acquisition of raw materials. In the context of its investments, Raiffeisen Capital Management also examines opportunities for sustainable investments in the raw material sector.

Karin Kunrath, Chief Investment Director, Raiffeisen Capital Management Photo RCM

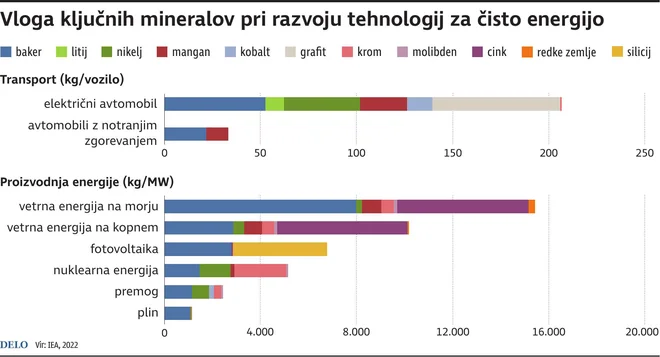

Raw material is a common topic in developing and young countries, but climate change does not know national borders. That is why we are intensively devoted to this issue. Our working group, which deals with raw materials as the theme of the future, has identified three trends within its analyzes: first, the world’s population is growing in cities, which needs infrastructure. Concrete, steel, aluminum and copper are key to creating infrastructure. The gearbox will be urbanization. Secondly, since raw materials are lacking, a circular economy in the raw material sector, including recycling of raw materials and auxiliary materials such as water, also plays an important role. And third, the global energy transition increases the demand for raw materials such as copper, cobalt and lithium. These are crucial for the performance of the energy transition and the protection of the climate.

Many questions regarding ESG

These three trends have a significant impact on the raw material. Concrete is still a key construction material when building urban settlements. But at the same time, the cement industry is one of the largest pollutants with greenhouse gases in the world. Wood is increasingly established as a building material and is an interesting alternative to concrete. It is a renewable raw material that is durable, lightweight, earthquake -resistant and often regionally accessible when properly used. Steel is standardized worldwide, but the method of production from an ESG point of view is quite different. Companies that use steel in the production process and which we invest in must answer many questions such as: Where does the steel come from, what processes are used for its production, where does the ore originated? The proportion of recycled material is also important in the decision.

A challenging rating that depends on durability

Particularly interesting is the raw material assessment that is crucial for the energy transition. Wind turbines, in addition to concrete and steel, also contain aluminum and copper. Cobalt, the so -called green factor, is also important, but it is a problematic mining in the Congo. We always check the origin of the cobalt and value the higher one that originates from Canada or Australia. Green factors are also copper and lithium used for network infrastructure and storage. Copper excavation causes soil pollution, with high water consumption, which affects the life of the local population. Therefore, when investing ESG, we need to pay extra attention to the way copper is obtained.

TD2_MINERALIO Photo GM/DK IGD

Recycling and future potential

Recycling is especially important for green crossing accelerators and will increase significantly, such as recycling batteries and reusing copper and other metals. This is an important topic for investment, which also includes raw materials, molybdenum, nickel, platinum, zinc, chromium, lead, graphite, wood, iron ore, cement and water. A working group examining developments in the raw materials market analyzes in detail any raw material, including its occurrence, intended use, production, recycling options and interchangeability, and prepares an inspection. Environmental, social and management risks for individual raw materials are included in the analysis, and solutions for their responsible acquisition are also given. When contacting companies, we follow guidelines that allow us to ask the right and key questions. Our transparent, understandable and responsible investment process for the raw material sector is seen as an important contribution to the responsible use of resources.

:format(jpeg):fill(f8f8f8,true)/s3/static.nrc.nl/taxonomy/bf9b707-commentaar-itemafbeelding-2024.png)